Tipalti

Founded Year

2010Stage

Series F - II | AliveTotal Raised

$706.25MLast Raised

$150M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About Tipalti

Tipalti is a global payables automation company that specializes in streamlining all phases of the accounts payable and payment management workflow. The company offers a cloud-based platform that simplifies the management of supplier payments, encompassing supplier onboarding, tax and regulatory compliance, invoice processing, and payments to suppliers worldwide in various methods and currencies. Tipalti's solutions are designed to reduce the workload for accounts payable departments and enhance financial and compliance controls. It was founded in 2010 and is based in Foster City, California.

Loading...

Tipalti's Product Videos

Tipalti's Products & Differentiators

Supplier Management

Designed to easily guide suppliers through submitting contact information, banking details, and tax forms, Tipalti’s intelligent, dynamic self-service supplier portal helps you effortlessly onboard vendors while improving supplier relationships with a best-in-class, web-based payments experience – all done in a few simple steps.

Loading...

Research containing Tipalti

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tipalti in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

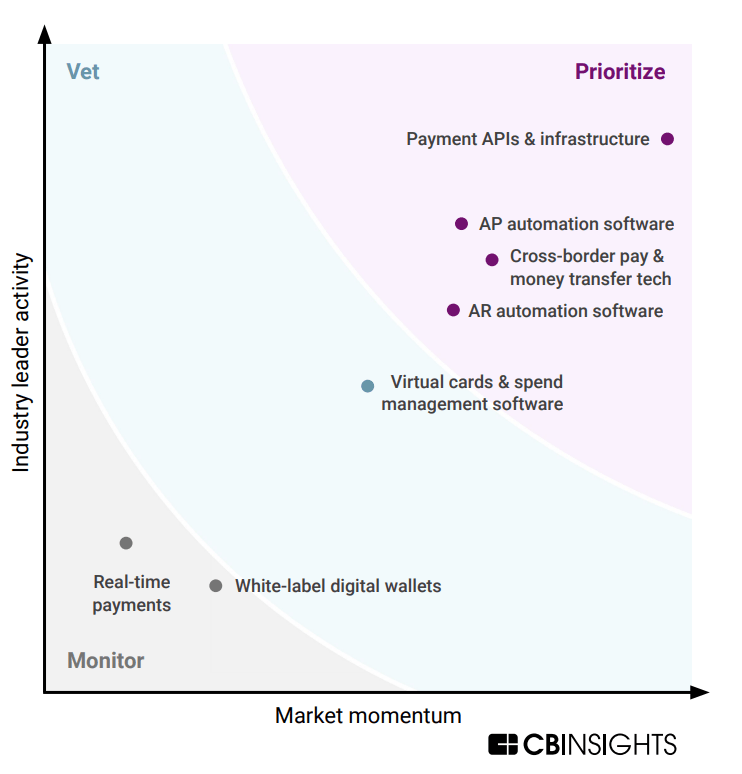

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 12, 2023

The procurement tech market mapExpert Collections containing Tipalti

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tipalti is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

2,003 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Tipalti News

Mar 28, 2025

Published An effective accounts payable automation software comparison can be the key to selecting the right solution that saves time, reduces errors, and boosts efficiency in financial operations. Accounts payable (AP) processes are critical for maintaining healthy cash flow and vendor relationships. However, manual AP tasks are time-consuming and prone to errors. With a wide variety of AP automation tools on the market, businesses must compare options carefully to make an informed choice. This article provides a comprehensive comparison of the top accounts payable automation software platforms in 2025, evaluating them based on features, integrations, ease of use, pricing, and customer support. Table of Contents What is Accounts Payable Automation? Accounts payable automation refers to the use of software to digitize and streamline the AP process, including invoice capture, approvals, payments, and reporting. These tools eliminate paper-based workflows and reduce human intervention, resulting in faster processing times and improved accuracy. Why an Accounts Payable Automation Software Comparison Matters Choosing the wrong software can lead to integration issues, user frustration, and even financial losses. That’s why conducting a thorough accounts payable automation software comparison is crucial before making an investment. Different platforms cater to different business sizes, industries, and needs. Key Features to Consider in AP Automation Software Before diving into our comparison, let’s outline the essential features businesses should look for in AP automation software: Invoice Capture & OCR: Automatically extract data from invoices using Optical Character Recognition. Approval Workflows: Route invoices for approval based on pre-defined rules. Payment Processing: Secure payment capabilities (ACH, checks, virtual cards). ERP Integration: Sync with accounting/ERP systems like QuickBooks, NetSuite, or SAP. Analytics & Reporting: Real-time dashboards and financial reports. Compliance & Security: Adhere to industry regulations and data security standards. Top Accounts Payable Automation Software Compared Here’s a detailed accounts payable automation software comparison of the top solutions in 2025: 1. Tipalti Invoice Management: Excellent OCR capabilities and multi-entity support. Payment Automation: Global payments in 190 countries, supports 120 currencies. ERP Integrations: Integrates with NetSuite, QuickBooks, Sage Intacct, and more. Pricing: Starts at $149/month. Benefits of Using Accounts Payable Automation Software Using an AP automation tool from the above accounts payable automation software comparison provides several advantages: Faster Invoice Approvals: Reduce approval times from days to hours. Lower Error Rates: Automated data capture minimizes manual entry mistakes. Improved Vendor Relationships: On-time payments strengthen partnerships. Fraud Prevention: Built-in controls and audit trails prevent misuse. Cash Flow Visibility: Real-time insights into outstanding liabilities. Common Challenges in AP Automation Implementation Even the best software from our accounts payable automation software comparison can face implementation hurdles. Some challenges include: Resistance to Change: Teams used to manual processes may be hesitant. Data Migration: Moving from legacy systems can be complex. Integration Issues: Ensuring compatibility with existing ERP systems. To mitigate these, it’s critical to involve stakeholders early, provide proper training, and select software with excellent customer support. How to Choose the Right Accounts Payable Automation Software Here are the steps to make the most informed choice: 1. Assess Your Business Needs Volume of invoices 2. Set a Budget Evaluate ROI instead of just upfront costs. Consider hidden fees such as implementation, integrations, or per-transaction charges. 3. Compare Features 4. Request Demos 5. Check Reviews and References Look at third-party reviews and speak with existing customers to understand strengths and weaknesses. Future Trends in AP Automation As technology evolves, here are some emerging trends in accounts payable automation: AI & Machine Learning: Predictive analytics and smart workflows. Blockchain for Payments: Transparent and secure payment tracking. Embedded Finance: AP software natively integrating with banks. Hyperautomation: Combining AP with RPA, AI, and ML for end-to-end finance automation. Final Thoughts This detailed accounts payable automation software comparison has covered the top platforms available in 2025, each offering unique features tailored to various business needs. Whether you’re a small business looking for simplicity or a multinational enterprise requiring global payments and compliance, there’s a solution out there for you. Investing in the right AP automation software is no longer optional—it’s a strategic necessity. Use this comparison as your guide to confidently choose the best accounts payable automation tool that aligns with your goals and drives efficiency across your finance team. Related Topics:

Tipalti Frequently Asked Questions (FAQ)

When was Tipalti founded?

Tipalti was founded in 2010.

Where is Tipalti's headquarters?

Tipalti's headquarters is located at 1051 E. Hillsdale Boulevard, Foster City.

What is Tipalti's latest funding round?

Tipalti's latest funding round is Series F - II.

How much did Tipalti raise?

Tipalti raised a total of $706.25M.

Who are the investors of Tipalti?

Investors of Tipalti include Hercules Capital, J.P. Morgan, Zeev Ventures, 01 Advisors, Durable Capital Partners and 10 more.

Who are Tipalti's competitors?

Competitors of Tipalti include Dost, Nook, Zip, Kyriba, Trolley and 7 more.

What products does Tipalti offer?

Tipalti's products include Supplier Management and 4 more.

Loading...

Compare Tipalti to Competitors

Billtrust provides accounts receivable automation and order-to-cash solutions within the financial services sector. The company offers services that improve the invoicing process, support multi-channel payments, and allow matching and posting for business-to-business transactions. Billtrust's solutions serve various industries, improving cash application and electronic handling of invoices and payments. It was founded in 2001 and is based in Hamilton, New Jersey.

Routable is a financial technology company that specializes in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Stampli focuses on accounts payable automation and invoice management. It offers a range of products to provide efficiency, visibility, and control for payments, employee expenses, corporate credit card spending, and vendor management. Stampli's services are primarily utilized by sectors such as healthcare, hospitality, professional services, construction, retail, and manufacturing. The company was founded in 2014 and is based in Mountain View, California.

Melio develops accounts payable solutions. The company offers services that allow businesses to pay their bills, send invoices, and receive payments online, as well as make international payments and automate their bill payment process. Its accountant dashboard enables integrations, team management, easy bill capture, and more. It primarily serves the business-to-business (B2B) payments in logistics, healthcare, construction, non-profit, and retail industries. It was founded in 2018 and is based in New York, New York.

CHERRY is a B2B payment processing solution that specializes in integrating accounting software with bank payment platforms. The company offers a plugin that automates payments, streamlines approvals, and facilitates reconciliation, thereby reducing manual processes for businesses. CHERRY primarily serves businesses looking to enhance their accounting and financial workflows through automation. It was founded in 2018 and is based in Brooklyn, New York.

ContaAzul offers software-as-a-service accounting and invoicing solutions for small businesses. Its services include quotes by email, contract management, sales management, electronic invoice management, and more. It was founded in 2011 and is based in Joinville, Brazil.

Loading...