Tractable

Founded Year

2014Stage

Series E | AliveTotal Raised

$184.83MLast Raised

$65M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-112 points in the past 30 days

About Tractable

Tractable focuses on artificial intelligence in the automotive and property insurance sectors. The company provides solutions for damage appraisal, assisting in the assessment and protection of vehicles and homes. Tractable's technology aims to improve claims processes, from reporting to settlement, and to support the appraisal of automotive parts. It was founded in 2014 and is based in London, United Kingdom.

Loading...

Tractable's Product Videos

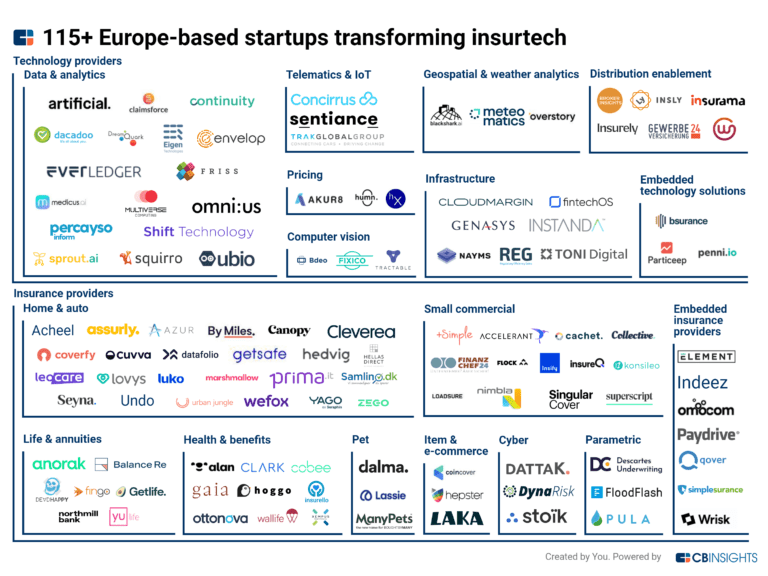

ESPs containing Tractable

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

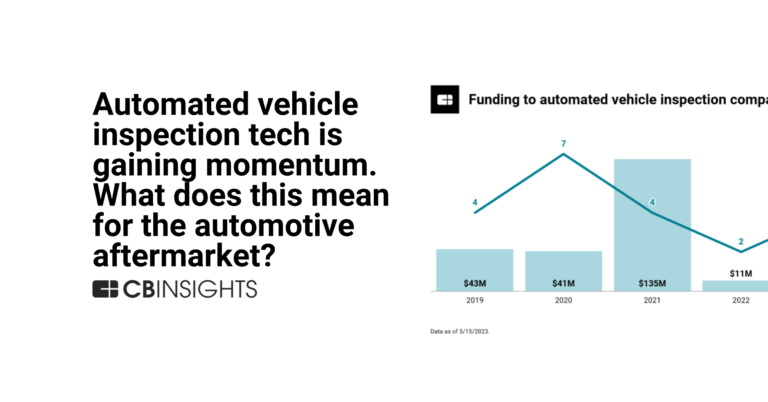

The virtual auto claims assessment market automates the analysis and assessment of auto insurance claims. These vendors typically use augmented reality and computer vision to analyze property claims data submitted by policyholders or adjusters. Additionally, some of these platforms have the ability to capture real-time data, from sources like telematics sensors, at scale. Insurance companies can b…

Tractable named as Leader among 13 other companies, including Verisk, CCC Intelligent Solutions, and Snapsheet.

Tractable's Products & Differentiators

AI Insant Quote

Instantly provide instant quotes to customers looking to understand how much it would cost to fix their vehicle. A Tractable link for a free estimate is placed on bodyshop website and customers can then input their info to begin the process, which requires 7 photos of the vehicle and a few pieces of information entered via a web app. Customer will then receive a quote on what the vehicle would cost to get repaired and can call the shop to schedule the repair, if they so please.

Loading...

Research containing Tractable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tractable in 10 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Dec 18, 2023

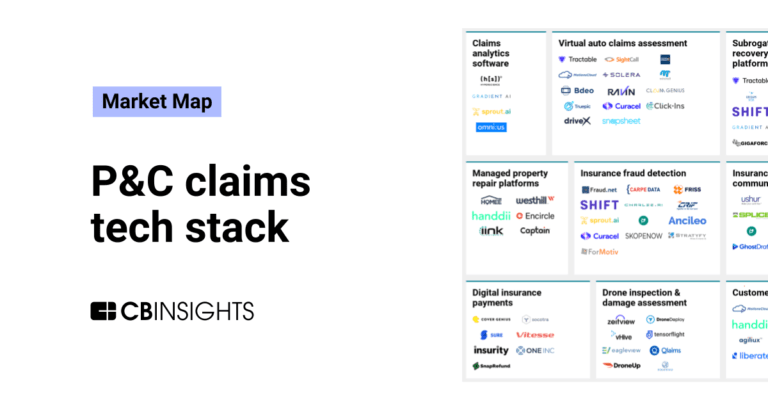

The P&C claims tech stack market map

Aug 1, 2023

Customer perspectives on the Insurtech 50

Expert Collections containing Tractable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tractable is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

AI 100

399 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Insurtech

4,483 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

10,027 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tractable Patents

Tractable has filed 21 patents.

The 3 most popular patent topics include:

- insurance

- machine learning

- vehicle insurance

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/11/2022 | 12/10/2024 | Marxian economics, Marxist terminology, Communist terminology, Socialism, Insurance | Grant |

Application Date | 2/11/2022 |

|---|---|

Grant Date | 12/10/2024 |

Title | |

Related Topics | Marxian economics, Marxist terminology, Communist terminology, Socialism, Insurance |

Status | Grant |

Latest Tractable News

Feb 14, 2025

Britain’s 10 biggest AI companies The biggest names in the world's third largest AI market AI Fri 14 Feb 2025 The UK is the third largest AI market in the world, behind only the United States and China and if the noise from the government is anything to go by, its AI sector will be one of its most important assets in the world. So, who are the biggest players in UK AI? Which companies are leading the way for what could be the most significant segment of the tech industry in the world? Determining what counts as an ‘AI company’ is in 2025 is a matter of interpretation as practically every tech firm in the world has some connection to artificial intelligence. This list is strictly looking at companies where the primary product and business is AI software, with an honourable mention to Arm, the Cambridge-based chip designer integral to the AI industry with a market cap of $165.7bn. Here are Britain’s 10 biggest AI companies. (Valuations are based on Dealroom data) ElevenLabs Valuation: $3.2bn Though it may top the list of the UK’s most valuable AI companies, ElevenLabs is also one of its youngest. Founded in 2022, the London and New York-based startup’s rise has been meteoric, going from a $2m (£1.58m) seed round in January 2023 to a $180m $500m Series C just two years later. ElevenLabs has built a text-to-speech system that eerily captures the realistic quirks of human speech. The company’s AI voice generation is available in over two dozen languages and has APIs available for others building AI voice tools. Backers include Andreessen Horowitz and Sequoia. Wayve Valuation: $3bn The UK’s biggest autonomous vehicle company, Wayve is at the forefront of what the British government expects to be a major technology of the future. Wayve develops the underlying software required for self-driving vehicle deployment. The company’s $1.05bn funding round in May last year defied an otherwise dreary period of investment in British businesses and its commitment to London as a “tech superpower” – in the words of CEO Alex Kendall – will provide comfort to a government desperate to keep the UK competitive in AI and autonomous driving. Wayve has received funding from the likes of SoftBank, Uber, Microsoft and NVIDIA. Synthesia Valuation: $2.1bn Synthesia, the developer of human-like AI avatars, held the honour of being Britain’s most valuable generative AI company …for about two weeks. Though its crown was taken by ElevenLabs, Synthesia remains the top company for what it does. Users can generate video presentations by simply inputting a script. Synthesia’s software will generate an uncannily human-esque speaker with increasingly lifelike body language and facial expressions (if you haven’t seen it in action, it is both genuinely impressive and a little terrifying). Investors include Google Ventures, Accel and MMC Ventures. Quantexa Valuation: $1.8bn Quantexa develops AI analytics tools are used to detect and prevent financial crime, an area of increasing importance with fraud costing the UK billions. It achieved its impressive valuation following a $129m Series E round in 2023. The company has been keen to establish itself as a global player, becoming the first British company to join the World Economic Forum’s Unicorn Community in January. Stability AI Valuation: $1bn At the best of times considered Britain’s answer to OpenAI, Stability has more recently been known for its… staffing issues . The company rose to prominence off the back of its image and video generating AI models, not unlike Dall-E and Sora. Though its technology is undeniably powerful, between 2023 and 2024, the company bled through senior management. The head of its audio team resigned over ethical issues regarding its position on the use of copyrighted material, and not long after it also lost its founding CEO Emad Mostaque, CTO Tom Mason and one of its original developers Tobin Rombach. Last year, the company was able to bring on a big name in AI to its board with the surprise appointment of Terminator director James Cameron. Builder Valuation: $1bn Described by a Microsoft executive has “creating an entirely new category” of AI business, Builder’s platform uses artificial intelligence to develop entire apps at the behest of its users, which includes JP Morgan Chase. The Microsoft-backed company has also received a healthy amount of support from the sovereign wealth fund of Qatar, which led its £200m Series D in 2023. Tractable Valuation: $1bn Bringing artificial intelligence to the insurance and disaster recovery industry, Tractable has built a platform trained on millions of datapoints that can analyse images of cars and homes to assess the damages and offer recommendations based on the result. Tractable became the UK’s first computer vision unicorn in 2021 courtesy of a $60m investment from Insight Partners and Georgian Partners and has since received additional funding from SoftBank’s Vision Fund II. Oxa Valuation: $560m – $840m Like Wayve, Oxa develops software for autonomous vehicles. The Oxford-based firm has deployed its tech in a number of commercial ventures, including shuttle services in Britain and the US. The Google-backed firm also recently set its sights on bringing self-driving technology to industrial logistics through the acquisition of StreetDrone. Google DeepMind Valuation: $800m By the standards of this list, DeepMind is a pretty old company, having been founded in the distant era of 2010. A true pioneer of modern AI, much of the success of the industry in the 2020s owes itself to the work of DeepMind’s researchers and engineers. The company received an offer to be bought by Mark Zuckerberg for $800m in 2014 but turned it down in favour of a lower offer from Google and has now become responsible for the nearly all the tech giant’s entire AI offering. As a standalone entity, its value would likely be in the tens of billions of dollars by now. In 2023, the DeepMind-made Gemini was launched to take on ChatGPT and remains Google’s flagship generative AI product. PolyAI Valuation: $500m Founded in 2017 as a spinout from the University of Cambridge, PolyAI develops AI-generated voices designed for customer service centres. Run by Nikola Mrkšić – a former Apple engineer who helped create the voice assistant Siri – PolyAI’s clients include Volkswagen and Marriott and Ceasar’s Entertainment. The company has been backed by NVentures, the VC arm of NVIDIA. Register for Free

Tractable Frequently Asked Questions (FAQ)

When was Tractable founded?

Tractable was founded in 2014.

Where is Tractable's headquarters?

Tractable's headquarters is located at 5 Appold Street, London.

What is Tractable's latest funding round?

Tractable's latest funding round is Series E.

How much did Tractable raise?

Tractable raised a total of $184.83M.

Who are the investors of Tractable?

Investors of Tractable include Insight Partners, Georgian, SoftBank, Ignition Partners, K5 Global Technology and 12 more.

Who are Tractable's competitors?

Competitors of Tractable include DriveX, UVeye, Trueclaim, Fixico, Curacel and 7 more.

What products does Tractable offer?

Tractable's products include AI Insant Quote and 4 more.

Who are Tractable's customers?

Customers of Tractable include https://kirmac.com/ and MS&AD.

Loading...

Compare Tractable to Competitors

Inspektlabs operates within the automotive and insurance industries and provides artificial intelligence-based digital vehicle inspections. The company offers a suite of products that enable damage detection, claim assessment, and fraud detection using photos and videos, thereby reducing the need for physical inspections. Inspektlabs primarily serves the automotive and insurance sectors with its technology solutions. It was founded in 2019 and is based in Middletown, Delaware.

Trueclaim focuses on vehicle damage detection within the automotive insurance and collision repair sectors. The company offers a platform utilizing machine learning and computer vision to automate the vehicle appraisal process, providing damage estimates and workflows for insurance companies and repair shops. It primarily serves the automotive industry. The company was founded in 2021 and is based in Laval, Canada.

UVeye serves as a computer vision technology company specializing in the development of automated inspection systems for vehicles within the automotive industry. The company's main offerings include AI inspection systems that utilize proprietary hardware to detect vehicle issues and security threats, particularly in the undercarriage. UVeye primarily serves sectors such as vehicle manufacturers, dealerships, fleet companies, and various security-sensitive facilities. It was founded in 2014 and is based in Teaneck, New Jersey.

Viewapp specializes in digital inspection technology through a smartphone application within the anti-fraud and inspection sectors. The application enables users to conduct remote self-inspections using pre-designed scenarios, with the results guaranteed to be protected against fraud. The app is used for various business purposes, including inspections according to detailed scenarios, photo and video documentation of assets such as real estate and vehicles, and monitoring the condition and presence of items for insurance or valuation purposes. It is based in Moscow, Russian Federation.

OpenClaims is a Software-as-a-Service provider specializing in digital repair management for the insurance, commercial fleet, and automotive industries. The company offers solutions that enable clients to manage repair and process costs, repair quality, and customer satisfaction through touchless, digital claims and repair processes. OpenClaims primarily serves the motor insurance, vehicle leasing, and automotive sectors with its digital claims and repair management solutions. It was founded in 2015 and is based in Amsterdam, Netherlands.

WeProov provides digital solutions for vehicle inspection and bodywork quoting within the automotive industry. The company has a mobile application and a management platform for conducting vehicle inspections, generating reports, and estimating bodywork repair costs. WeProov serves car rental companies, fleet managers, and insurance brokers and companies. It was founded in 2015 and is based in Neuilly-sur-Seine, France.

Loading...