TradingView

Founded Year

2011Stage

Series C | AliveTotal Raised

$339.37MValuation

$0000Last Raised

$298M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-38 points in the past 30 days

About TradingView

TradingView is a financial charting platform and social network for traders and investors. The company provides tools for real-time market data analysis, enabling users to share and discuss trading strategies within an investment community. TradingView offers a suite of market analysis tools, including access to an economic calendar, collaborative trading ideas, and a custom scripting language for advanced charting. It was founded in 2011 and is based in Westerville, Ohio.

Loading...

TradingView's Product Videos

ESPs containing TradingView

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. It empowers financial institutions with historical and real-time fundamental (on chain) and market data for research, trading, risk analytics, reporting, and compliance. The market is fragmented and lacks standardization, making it complex a…

TradingView named as Leader among 14 other companies, including Coin Metrics, Nansen, and Kaiko.

TradingView's Products & Differentiators

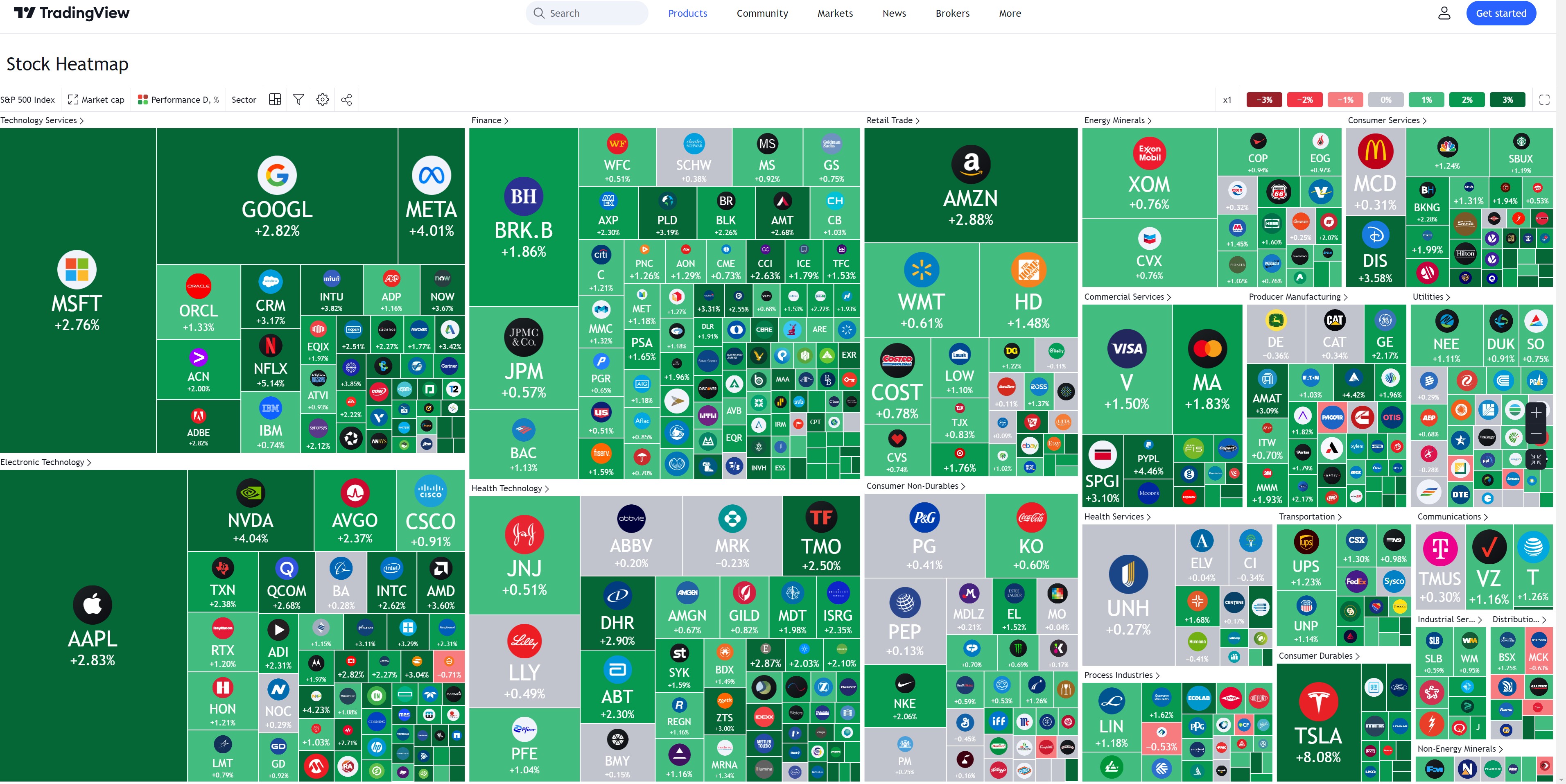

Charts

Best in class charts enabling comprehensive technical analysis of the markets

Loading...

Research containing TradingView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TradingView in 1 CB Insights research brief, most recently on Nov 11, 2022.

Nov 11, 2022

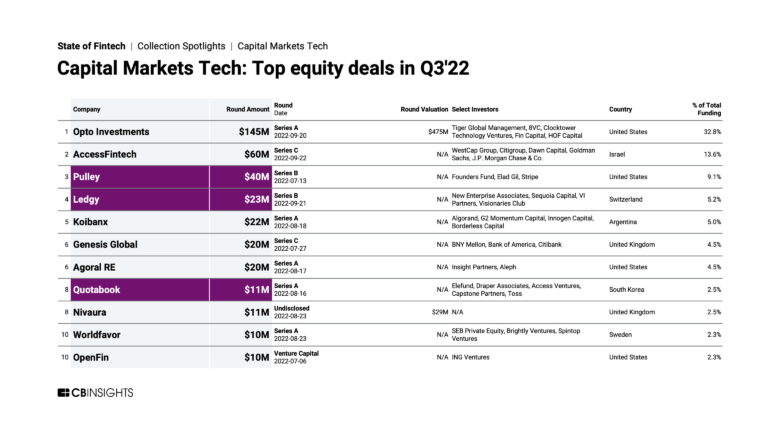

3 capital markets trends to watchExpert Collections containing TradingView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TradingView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,042 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest TradingView News

Apr 11, 2025

TradingView Expands Data and Crypto Access With Morningstar Indices and BitMEX Share TradingView has rolled out two major updates that significantly broaden the platform’s reach across traditional finance and crypto markets. Users can now access Morningstar’s global indices directly on TradingView and trade crypto derivatives via BitMEX without leaving their charts. Morningstar Indices Covers Over 25,000 Across Asset Classes and Strategies The addition of Morningstar Indices gives users access to one of the industry’s most comprehensive collections of market benchmarks. Established in 2001, Morningstar’s index division provides over 25,000 indices across asset classes and strategies. Built on more than three decades of financial data research, these indices are now accessible via TradingView by searching with the “MSTAR:” prefix in the platform’s symbol search tool. This integration allows investors to monitor a wide range of sectors and regions — from U.S. large-cap benchmarks to thematic indices like entertainment and emerging industries. Morningstar, founded over 40 years ago, shares TradingView’s goal of making institutional-grade data available to all users, from professional analysts to individual investors. BitMEX Interface Covers Over 200 Crypto Derivatives Products In parallel, TradingView has also introduced BitMEX trading to its crypto interface, giving users access to over 200 cryptocurrency derivatives products. Known for its reliability and deep liquidity, BitMEX offers perpetual swaps, pre-launch futures, and even prediction markets — all now available for live execution within the TradingView charting interface. BitMEX has maintained a strong operational security record since its inception, incorporating Multi-party Computation (MPC) technology and cross-verification of balances with on-chain data. In 2021, it became one of the first exchanges to publish Proof of Reserves, enhancing transparency for users. Its $3 billion insurance fund further protects against liquidation risks. To trade with BitMEX on TradingView, users can simply open the trading panel, select the BitMEX icon, and log in to their account. This integration enhances TradingView’s multi-asset coverage, bridging traditional markets with the evolving digital asset space. With these updates, TradingView strengthens its position as a unified platform for comprehensive market analysis and execution — now offering direct access to more than two million instruments globally, from indices and equities to crypto derivatives. Blueberry Is Latest FX/CFD Broker to Join TradingView Blueberry was the latest FX/CFD broker to join TradingView’s social network for traders and investors. The partnership aims to enhance the trading experience for Blueberry customers by providing access to TradingView’s powerful charting tools, advanced technical analysis, and social trading features. The partnership will also include a co-branded campaign designed to position Blueberry as an innovative leader in the trading space. At the heart of this partnership is the integration of TradingView’s industry-leading charting and analysis tools with Blueberry’s platform. With TradingView’s advanced charting features, Blueberry customers will gain access to a wide array of powerful tools designed to improve their trading performance. These tools are built for traders of all experience levels, from beginners to seasoned professionals, and are especially useful for those looking to conduct deep technical analysis.

TradingView Frequently Asked Questions (FAQ)

When was TradingView founded?

TradingView was founded in 2011.

Where is TradingView's headquarters?

TradingView's headquarters is located at 470 Olde Worthington Rd, Westerville.

What is TradingView's latest funding round?

TradingView's latest funding round is Series C.

How much did TradingView raise?

TradingView raised a total of $339.37M.

Who are the investors of TradingView?

Investors of TradingView include Tiger Global Management, Insight Partners, DRW Venture Capital, Jump Capital, OkCupid and 8 more.

Who are TradingView's competitors?

Competitors of TradingView include TakeProfit, TipRanks, MacroMicro, Atom Finance, StockViva and 7 more.

What products does TradingView offer?

TradingView's products include Charts and 4 more.

Loading...

Compare TradingView to Competitors

Seeking Alpha is a financial services company that provides stock market analysis and investment tools. The company has a platform for investors to access investment research, including stock ideas, market news, and analysis of various financial instruments such as stocks, ETFs, and mutual funds. Seeking Alpha serves individual investors by offering tools and resources for making investment decisions. It was founded in 2004 and is based in New York, New York.

MetaTrader 5 is a trading platform for Forex, stocks, and futures markets within the financial services industry. The platform includes tools for technical and fundamental analysis, trading alerts, and automated trading, designed for individual traders and financial institutions. MetaTrader 5 provides services such as virtual hosting, mobile and web trading applications, and access to a marketplace for trading robots and indicators. It is based in Limassol, Cyprus.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

MarketSeer provides fundamental market research solutions for investments using its integrated platform. It provides benefits such as real-time market data and analysis, breaking news and expert commentary, in-depth research reports, investment ideas, interactive tools, and financial calculators. The company was founded in 2019 and is based in Johannesburg, South Africa.

Simply Wall St focuses on financial data simplification and investment research tools within the financial services sector. The company offers a platform that provides visual financial reports, fundamental analysis, portfolio tracking, and stock screening tools. It was founded in 2014 and is based in Sydney, Australia.

Stock Target Advisor specializes in financial market analysis and operates within the financial technology industry. The company offers tools including an automated stock screener, aggregator of analyst ratings, and market news. Stock Target Advisor serves individual and professional investors seeking to improve their strategies using data. It was founded in 2018 and is based in Waterloo, Ontario.

Loading...