TransferMate

Founded Year

2010Stage

Unattributed | AliveTotal Raised

$129.89MValuation

$0000Last Raised

$70M | 3 yrs agoAbout TransferMate

TransferMate is a global B2B payments technology company that specializes in cross-border transactions within the financial technology sector. The company offers services that facilitate international payments, provide virtual multi-currency accounts, and integrate with enterprise resource planning systems for businesses and financial institutions. TransferMate's technology enables clients to execute global payments with enhanced exchange rates, transparency, and security. It was founded in 2010 and is based in Kilkenny, Ireland. TransferMate operates as a subsidiary of Clunetech.

Loading...

TransferMate's Product Videos

_thumbnail.png?w=3840)

TransferMate's Products & Differentiators

Payables

A global payments infrastructure capable of hitting local, high value ACH and instant rails.

Loading...

Research containing TransferMate

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TransferMate in 5 CB Insights research briefs, most recently on Aug 23, 2024.

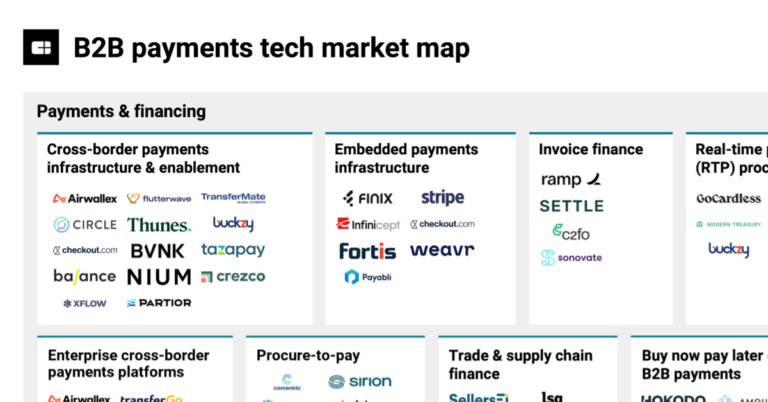

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market mapExpert Collections containing TransferMate

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TransferMate is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Latest TransferMate News

Mar 25, 2025

RTGS.global and TransferMate partner Tuesday 25 March 2025 15:17 CET | News RTGS.global and TransferMate have formed a strategic partnership to improve the efficiency of cross-border payments for global businesses. This collaboration integrates TransferMate’s payment services into RTGS.global’s real-time settlement network, providing businesses with simple, instant international payment capabilities. The partnership will enable TransferMate to leverage RTGS.global’s instant settlement infrastructure to offer real-time, cross-border transactions. By reducing dependence on traditional banking intermediaries, this integration eliminates risks often associated with international money transfers, ensuring a faster, more secure payment process. RTGS.global’s real-time atomic settlement solution addresses long-standing challenges in cross-border payments, such as liquidity management and transaction delays. Through this collaboration, businesses will benefit from quick, secure, and risk-free transactions across various currencies and regions, mimicking the ease of domestic transfers. Global reach and increased efficiency The partnership between RTGS.global and TransferMate expands the reach of RTGS.global network to over 200 countries and territories. This expansion allows businesses to improve liquidity, lower transaction costs, and accelerate payment processing times. By joining the RTGS.global network, TransferMate is set to provide clients with increased operational efficiency, offering a fully regulated, secure environment for cross-border transactions. This global reach is increased by TransferMate’s strong regulatory standing, with over 100 licences supporting its operations worldwide. Eliminating intermediaries and reducing costs One of the key advantages of RTGS.global’s network is its Payment vs. Payment (PvP) system, which eliminates intermediary fees and the need for pre-funding bank accounts, a common requirement in traditional correspondent banking services. This peer-to-peer system ensures that payments are completed instantly without the involvement of additional financial intermediaries. The collaboration between RTGS.global and TransferMate aims to reshape the landscape of cross-border payments. With the demand for real-time, secure, and cost-effective settlement solutions growing, the partnership is positioned to address the inefficiencies of traditional payment systems. As the global financial sector moves towards T+1 settlement cycles, this partnership will offer businesses the opportunity to perform B2B transactions with greater speed, transparency, and security. The combined solutions from both companies provide a comprehensive response to the challenges of liquidity management and cross-border payments. This partnership marks a significant milestone in the evolution of global payments, with the potential to redefine industry standards for speed, security, and transparency in cross-border transactions. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

TransferMate Frequently Asked Questions (FAQ)

When was TransferMate founded?

TransferMate was founded in 2010.

Where is TransferMate's headquarters?

TransferMate's headquarters is located at IDA Business and Technology Park, Ring Road, Kilkenny.

What is TransferMate's latest funding round?

TransferMate's latest funding round is Unattributed.

How much did TransferMate raise?

TransferMate raised a total of $129.89M.

Who are the investors of TransferMate?

Investors of TransferMate include Railway Pension Trustee Co. Ltd., ING and Allied Irish Banks.

Who are TransferMate's competitors?

Competitors of TransferMate include Zepz, TerraPay, Qbit, Skydo, MOIN and 7 more.

What products does TransferMate offer?

TransferMate's products include Payables and 3 more.

Who are TransferMate's customers?

Customers of TransferMate include Ruhrpumpen, Paycheck Plus, HDI Global, American College Dublin and Vat America.

Loading...

Compare TransferMate to Competitors

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, United Kingdom.

Airwallex develops a global financial platform that focuses on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Finofo focuses on global banking, accounts payable automation, and foreign exchange in the financial technology domain. The company offers a platform that allows businesses to hold multi-currency accounts, convert currencies, automate accounts payable, and make international payments. It primarily serves the business finance sector. The company was founded in 2022 and is based in Calgary, Canada.

MoneyGram operates as a financial services company. The company offers services such as sending money to various locations worldwide, depositing money into bank accounts, and transferring funds to mobile wallets. It primarily serves individuals who need to send or receive money internationally. MoneyGram was formerly known as Integrated Payment Systems, It was founded in 2003 and is based in Minneapolis, Minnesota.

MOIN is a financial technology company specializing in blockchain-based remittance services. The company offers a platform for sending money internationally. MOIN's services are utilized by individuals needing to transfer funds across borders, including students seeking discounted transfer fees. It was founded in 2016 and is based in Seoul, South Korea.

Verto operates as a business-to-business (B2B) cross-border payments platform. It provides financial technology and services for businesses. The company offers products including multi-currency business accounts, global expense management, foreign exchange (FX) and treasury management, and invoice payment processing, which facilitate international transactions and financial operations. Verto serves startups, mid-size companies, and enterprises across various sectors that require cross-border payment solutions and currency management. It was founded in 2017 and is based in London, United Kingdom.

Loading...