TrueLayer

Founded Year

2016Stage

Series E - II | AliveTotal Raised

$321.8MValuation

$0000Last Raised

$50M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+74 points in the past 30 days

About TrueLayer

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Loading...

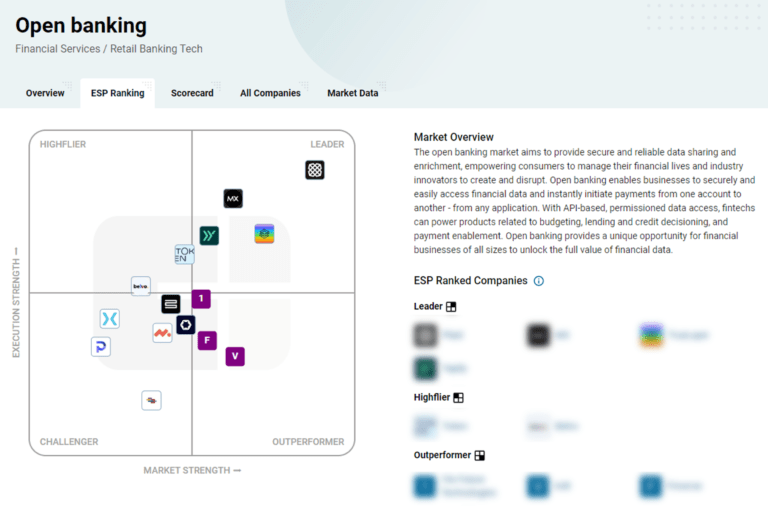

ESPs containing TrueLayer

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The identity verification market focuses on providing technologies and processes to verify the identities of individuals in both online and offline interactions, as well as prevent identity fraud. These solutions cater to a wide variety of industries and include new account and also synthetic fraud prevention, which involve bad actors stealing all or part of a person’s information to open new acco…

TrueLayer named as Highflier among 15 other companies, including SAP, Ping Identity, and Onfido.

TrueLayer's Products & Differentiators

Data API

Connect an app to any bank account: delivering real-time access to account, balance, transaction, and identity data using open banking AIS.

Loading...

Research containing TrueLayer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TrueLayer in 6 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing TrueLayer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TrueLayer is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,819 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,699 items

Excludes US-based companies

Digital ID In Fintech

268 items

For this analysis, we looked at digital ID companies working in or with near-term potential to work in fintech applications. Startups here are enabling fintech companies to verify government documents, authenticate with biometrics, and combat fraudulent logins.

Latest TrueLayer News

Apr 7, 2025

Monday 7 April 2025 10:40 CET | News Papa Johns has introduced TrueLayer ’s Pay by Bank solution across the UK, allowing customers to make direct payments from their bank accounts. This integration aims to provide a simple and secure payment experience while reducing costs for the food and beverage giant. Leveraging Open Banking technology, the Pay by Bank feature enables transactions to be authenticated in real time, often using biometric verification through banking apps. By bypassing traditional card networks, this payment method minimises fraud risks and eliminates chargebacks, making it an attractive option for merchants and consumers alike. For businesses, Pay by Bank offers significant cost savings compared to card-based payments. Papa Johns expects a reduction of over 40% in payment processing costs, with savings that can be reinvested into customer incentives and loyalty programs. Additionally, the feature accelerates payment settlements, improving cash flow for merchants. Instant refunds further improve the customer experience, ensuring a smoother resolution process in case of order adjustments. Expanding consumer adoption Pay by Bank is gaining traction among digital-savvy consumers. TrueLayer’s network of 12 million users has shown a 25% increase in first-time conversion rates when using this payment method. The added convenience and security of bank-to-bank transactions make it a compelling alternative to traditional card payments. The adoption of Pay by Bank solutions is experiencing significant growth across Europe, driven by regulatory advancements, technological innovations, and shifting consumer preferences. Consumer behavior reflects this trend, as the European Central Bank 's 2024 study indicates that cash transactions at points of sale have declined to 52%, down from 79% in 2016, while card payments have risen to 39%. Notably, mobile payments have doubled to 6%, underscoring a growing inclination towards digital payment methods. This shift is further evidenced by the increasing number of Open Banking users in Europe, projected to reach 63.8 million by 2024 , up from 12.2 million in 2020. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

TrueLayer Frequently Asked Questions (FAQ)

When was TrueLayer founded?

TrueLayer was founded in 2016.

Where is TrueLayer's headquarters?

TrueLayer's headquarters is located at 40 Finsbury Square, London.

What is TrueLayer's latest funding round?

TrueLayer's latest funding round is Series E - II.

How much did TrueLayer raise?

TrueLayer raised a total of $321.8M.

Who are the investors of TrueLayer?

Investors of TrueLayer include Northzone, Temasek, Stripe, Tiger Global Management, Tencent and 15 more.

Who are TrueLayer's competitors?

Competitors of TrueLayer include Plaid, Volt, Bud, Yaspa, Here and 7 more.

What products does TrueLayer offer?

TrueLayer's products include Data API and 3 more.

Loading...

Compare TrueLayer to Competitors

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Meniga specializes in digital banking solutions within the financial technology sector. The company offers a suite of products that enhance digital banking experiences by leveraging data consolidation, customer engagement, and revenue generation strategies. Meniga primarily serves financial institutions looking to improve their digital services. It was founded in 2009 and is based in London, United Kingdom.

Here offers an enterprise browser that aims to improve productivity and security for various work applications without the need for technical knowledge. It primarily serves sectors such as the financial services industry, government agencies, and contact centers, providing tailored solutions for workflow and operational automation. It was formerly known as OpenFin. The company was founded in 2010 and is based in New York, New York.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Trustly Group focuses on open banking solutions in the financial services and payment processing sectors. The company provides products that facilitate payments, consumer onboarding, and risk assessment using bank-validated financial data. Trustly Group serves sectors including billers, eCommerce, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...