Truveta

Founded Year

2020Stage

Series C | AliveTotal Raised

$515MValuation

$0000Last Raised

$320M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+63 points in the past 30 days

About Truveta

Truveta provides electronic health record (EHR) data and analytics within the healthcare sector. The company offers EHR data, including clinical notes and images, linked with social determinants of health, mortality, and claims data for research and development purposes. Truveta's solutions are used by life science, government, academic, health system, and research entities. It was founded in 2020 and is based in Bellevue, Washington.

Loading...

ESPs containing Truveta

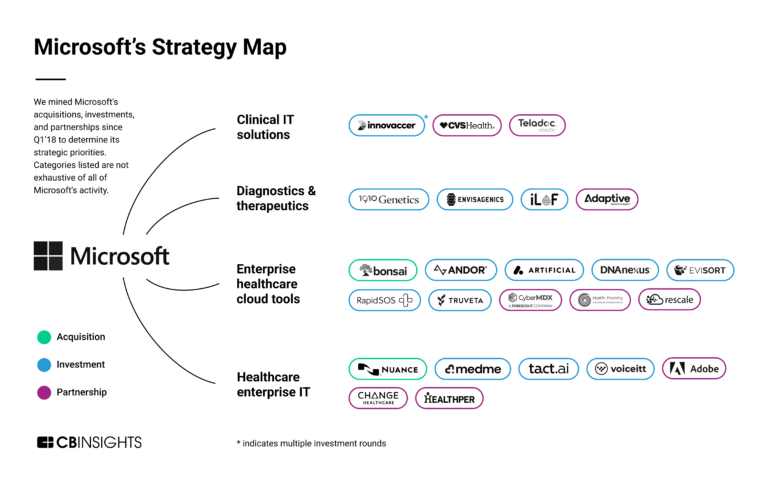

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The real-world data providers market offers a variety of value propositions to the pharmaceutical industry, drug labs, and healthcare organizations. It provides access to diverse patient populations, longitudinal real-world data, and patient-powered or EHR-powered controls that can replicate real-world scenarios. This can help shorten drug development timelines, reduce patient recruitment burdens …

Truveta named as Leader among 15 other companies, including IQVIA, Tempus, and Datavant.

Loading...

Research containing Truveta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Truveta in 2 CB Insights research briefs, most recently on Aug 21, 2024.

Aug 21, 2024

The clinical trials tech market mapExpert Collections containing Truveta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Truveta is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Health

11,306 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Digital Health 50

150 items

2022's cohort of the most promising digital health startups transforming the healthcare industry. Winners were chosen based on several factors, including data submitted by the companies, proprietary Mosaic scores, company business models and momentum in the market.

Artificial Intelligence

7,221 items

Truveta Patents

Truveta has filed 7 patents.

The 3 most popular patent topics include:

- health informatics

- electronic health records

- information privacy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/8/2022 | Health informatics, Electronic health records, Telehealth, Medical terminology, Information privacy | Application |

Application Date | 11/8/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Health informatics, Electronic health records, Telehealth, Medical terminology, Information privacy |

Status | Application |

Latest Truveta News

Apr 8, 2025

Apr 8, 2025 • Stephen Hurford There were 1,215 corporate-backed startup funding rounds in Q1, the highest quarterly total for two years. Thanks to two extraordinarily large deals, Q1 2025 was a record quarter for the amount of capital raised in corporate-backed funding rounds. OpenAI raised $40bn at the end of March, in the largest ever funding round for a private tech company. In January, the big data analytics company Databricks raised $10bn. These two deals made up more than half of the $85.9bn in total funding raised across rounds where the value was disclosed. This is the largest amount raised in a quarter since 2021, showing that corporate investors are continuing to take large bets on US AI companies, even after the emergence of the Chinese rival DeepSeek posed a challenge to their business models. The OpenAI round was led by SoftBank , which has for the last decade been a prominent venture investor in emerging tech trends. The company’s former CFO recently told GCV that despite its patchy record on previous investments, he thinks SoftBank’s funding of AI infrastructure is a strong bet. Leaving the large deals to one side But these anomalous investments do not tell us much about CVC as a whole. We can get a better idea of the underlying state of corporate venturing for the quarter if we take out the distortive funding rounds totalling over $1bn. This gives a flatter graph which makes for a more reliable comparison between the quarters: What it shows is that, even without the very large deals included, there is still a discernible upward trend since the dip to the low point of Q4 2023, in a shallow U shape. Some of the largest sub-$1bn deals were in China, where state-owned corporations invest heavily into capital intensive startups including Shenzhen Energy Environment, a waste management company that raised $691m. XCMT, an electric vehicle fleet company covered in GCV’s February data roundup , raised $881m. But European startups also raised in the hundreds of millions. Germany’s Reneo, a company providing turnkey decarbonisation services for residential buildings, raised $627m in a series B raise. In the UK, Isomorphic Labs, a spinout from Alphabet’s DeepMind which uses AI in drug discovery, raised $600m from Alphabet and Thrive Capital, a VC firm. The highest number of deals for two years In terms of deal volume, Q1 2025 also saw unusually high activity, reaching a total of 1,215 corporate-backed deals. This is the most in one quarter since 2022, and is a 29% increase on the same period last year. This high deal volume was largely focused in the fintech, healthcare, industrial and IT sectors. All of them showed the highest number of deals in a quarter since 2022. The graph below gives an idea of how the mix between sectors has shifted over the last two years. Industrial startups: rise of the robots When comparing the Q1 2025 data to Q1 2024, the number of deals for robotics and drone startups rose by 183% between the periods, with 34 deals recorded in Q1 2025 versus 12 the year before. This is the largest percentage change of any of the sub-sectors that make up the industrial category. In last month’s data roundup, we noted that some of the largest robotics investments were for companies making humanoid robots. Zoom out for the whole quarter, and it’s clear that these are attracting strong investor interest in 2025. The US humanoid robot maker Apptronik raised $350m in February, with Alphabet participating. Germany’s Neura Robotics raised $124m and China’s Fourier Intelligence raised $109m, both of which held funding rounds in January. Neura Robotics has released video demos of one its robots, called the 4NE-1, which is designed for performing domestic chores. Fourier started by making robotic rehabilitation devices for people suffering disabilities. It pivoted to designing humanoid robots in 2019, and recently demoed the second iteration of one of its models. IT deals: can the world still stomach software? GCV has previously reported on the threat that AI poses to the traditional enterprise software business model. Current packages are designed around the fact that a human being will be interacting with the system, like a sales rep entering details in a CRM. But with the increasing sophistication of AI models, we are moving into a world where software will have to be designed for an AI product that interacts directly with the system. And so investors have told GCV that they are taking a close interest in AI-based software platforms and AI agents , to see where things are heading. The quarterly data appears to support this. A comparison between Q1 2024 and Q1 2025 shows a 23% drop in enterprise software deals, despite every other IT subsector we track rising over the period. And this is not just a story of shifting deal volume. AI startups generally attract larger investments, according to our data. The average corporate-backed funding round for an AI startup was $42m, excluding the large $1bn+ deals. For enterprise software startups, the figure is $34m. Semiconductors: Chinese investment continues to rise Semiconductor investments nearly tripled between Q1 2024 and Q1 2025. The bulk of the 2025 figure came from Chinese startup funding rounds, which account for 25 of the 41. China’s semiconductor sector had shown strong investor activity in February with eight deals, but March was an even hotter month, with 12. GCV+ subscribers can see all these Chinese semiconductor deals — as well as deals from hundreds of other subsectors and countries — in our CVC Funding Round Database . Health: the core areas show large rises Health startups had a strong quarter compared to Q1 2024. Pharmaceutical, healthcare IT – which includes telemedicine and health-specific software – and medical device startups all increased deals considerably on the prior year. This was more pronounced for healthcare IT and medical devices, which saw 92% and 81% increases, respectively. Among the large healthcare IT deals was the $320m series A round for Truveta, a US developer of a software platform that uses clinical data to help researchers accelerate therapy development. Microsoft participated in the round. Abridge, another US startup, makes software that transcribes medical conversations and highlights and defines key terms for patients. It raised $250m in an undisclosed round, with participation from Alphabet. An Irish medical device startup, Fire1, which makes remote monitoring devices for patients suffering from heart failure, raised $120m from investors that include Novo Holdings , the investment vehicle for Novo Nordisk. A Chinese company that also makes medical devices for heart failure, Pulnovo, raised a $100m series C round that Eli Lilly took part in. The biggest investors of the quarter It is no surprise that Alphabet leads the quarter by the number of deals. The tech conglomerate is a voracious investor and always comes out top in the monthly roundups. But the quarterly view puts in perspective how much more investment appetite it has than other corporates, accounting for more than double the volume of the next biggest investor, Samsung. Another advantage of the quarterly ranking is that it shows where the consistent investment is coming from. February and January’s totals included CVCs like those belonging to Flipkart , Telefónica and Labcorp , which all had unusually prolific months. But over a three-month period, the large tech, pharmaceutical and energy companies tend to dominate, challenged only by financial institutions and the crypto companies that make lots of small bets in niche blockchain technology. GCV+ subscribers can browse our CVC Directory to see full details of corporate venture units like Flipkart Ventures, Telefónica’s Wayra and Labcorp Venture Fund Stephen Hurford

Truveta Frequently Asked Questions (FAQ)

When was Truveta founded?

Truveta was founded in 2020.

Where is Truveta's headquarters?

Truveta's headquarters is located at 1745 114th Avenue South East, Bellevue.

What is Truveta's latest funding round?

Truveta's latest funding round is Series C.

How much did Truveta raise?

Truveta raised a total of $515M.

Who are the investors of Truveta?

Investors of Truveta include Providence, CommonSpirit Health, Advocate Health, Illumina, Northwell Health and 9 more.

Who are Truveta's competitors?

Competitors of Truveta include Tasq.ai, Medicom, Atropos Health, Endimension, Dandelion and 7 more.

Loading...

Compare Truveta to Competitors

nference is a healthcare technology company specializing in clinical artificial intelligence (AI) and evidence. The company offers a platform that uses healthcare data to manage clinical data, support research, and work with patient outcomes through artificial intelligence. nference primarily serves the healthcare sector, providing solutions for clinical researchers, data scientists, and healthcare systems. It was founded in 2013 and is based in Cambridge, Massachusetts.

Aetion provides real-world evidence solutions within the healthcare sector. The company offers software and services that analyze real-world data to provide insights on the safety, effectiveness, and value of medical treatments and technologies. Its clientele includes biopharma companies and government agencies to inform health care decisions and guide product development. It was founded in 2013 and is based in New York, New York.

Commure is a technology company that develops software and AI solutions for healthcare systems. The company offers products for provider, administrator, and patient workflows, including tools for clinical documentation, revenue cycle management, and patient engagement. Commure's technologies aim to assist the healthcare workforce, allowing providers to allocate more time to patient interactions. Commure was formerly known as PatientKeeper. It was founded in 2017 and is based in Mountain View, California.

Zus Health is a shared health data platform that aims to improve healthcare data interoperability. The company offers the Zus Aggregated Profile, which provides a view of a patient's healthcare interactions, intended for use at the point of care through integrations such as API, embedded components, and direct EHR systems. Zus Health serves healthcare organizations seeking to improve patient data access and care team efficiency. Zus Health was formerly known as Zeus Healthcare Technologies. It was founded in 2020 and is based in Boston, Massachusetts.

Owkin is an AI biotechnology company that employs artificial intelligence to improve drug discovery and development in the biopharmaceutical sector. The company specializes in AI-based identification of new treatments, clinical trial optimization, and diagnostic tool creation, while ensuring patient privacy through federated learning techniques. Owkin serves the biopharma and academic research communities. It was founded in 2016 and is based in New York, New York.

Five Sigma provides AI technology products for insurance claims management, including a cloud-based claims management platform (CMS) and Clive™, an AI claims adjuster working on top of any CMS. Five Sigma streamlines claims processing with automation, real-time insights, and easy integrations with other systems. Designed for insurers, MGAs, TPAs, and self-insured enterprises, Five Sigma aims to enhance efficiency and reduce costs in claims operations. It was founded in 2017 and is based in Rocky Hill, Connecticut.

Loading...