Two

Founded Year

2020Stage

Series A - II | AliveTotal Raised

$30.96MLast Raised

$19.4M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-26 points in the past 30 days

About Two

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors, including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

Loading...

Two's Product Videos

ESPs containing Two

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Two named as Challenger among 15 other companies, including Affirm, PayPal, and Hokodo.

Two's Products & Differentiators

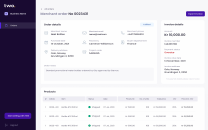

E-Commerce Checkout

A B2B Net Terms checkout payment solution for e-commerce transactions.

Loading...

Research containing Two

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Two in 3 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Two

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Two is included in 4 Expert Collections, including Digital Lending.

Digital Lending

2,577 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

100 items

Two Patents

Two has filed 16 patents.

The 3 most popular patent topics include:

- babycare

- infancy

- pediatrics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/28/2018 | 10/1/2024 | Dosage forms, Bones of the pelvis, Medical equipment, Pelvis, Drug delivery devices | Grant |

Application Date | 9/28/2018 |

|---|---|

Grant Date | 10/1/2024 |

Title | |

Related Topics | Dosage forms, Bones of the pelvis, Medical equipment, Pelvis, Drug delivery devices |

Status | Grant |

Latest Two News

Feb 22, 2025

Revolutionizing Payment Processes through Open Banking for Enhanced User... Two and Avarda join forces to introduce a fully integrated white-label payment solution for the Nordic e-commerce market, enhancing both B2B and B2C transactions Highlights The collaboration introduces a fully integrated white-label payment solution. The solution aims to enhance both B2B and B2C transactions in the Nordic e-commerce market. Summary Two, a European leader in B2B payments technology, has announced a strategic partnership with Avarda, a white-label payments specialist in northern Europe. Together, they are introducing a fully integrated white-label payment solution tailored for both businesses and consumers in the Nordic e-commerce market. This collaboration aims to streamline B2B and B2C transactions, providing a seamless, digital-first payment experience for merchants and buyers alike. By leveraging Two’s B2B Buy Now, Pay Later (BNPL) technology and Avarda’s B2C payment expertise, the partnership seeks to enhance operational efficiency and customer satisfaction in the region Tags

Two Frequently Asked Questions (FAQ)

When was Two founded?

Two was founded in 2020.

Where is Two's headquarters?

Two's headquarters is located at Kongens gate 6, Oslo.

What is Two's latest funding round?

Two's latest funding round is Series A - II.

How much did Two raise?

Two raised a total of $30.96M.

Who are the investors of Two?

Investors of Two include Sequoia Capital, LocalGlobe, Shine Capital, Antler, Visionaries Club and 8 more.

Who are Two's competitors?

Competitors of Two include Hokodo, Kriya, Ledyer, Balance, Biller and 7 more.

What products does Two offer?

Two's products include E-Commerce Checkout and 3 more.

Who are Two's customers?

Customers of Two include Hofy, REKKI and Eplehuset.

Loading...

Compare Two to Competitors

Mondu specializes in Buy Now, Pay Later (BNPL) solutions for B2B transactions within the financial services sector. The company offers a suite of payment solutions that allow businesses to provide their customers with various deferred payment options, including flexible payment terms, installment plans, and digital trade accounts. Mondu primarily serves the ecommerce industry, B2B marketplaces, and multichannel sales sectors. It was founded in 2021 and is based in Berlin, Germany.

Hokodo specializes in B2B (business-to-business) payment solutions, offering a digital platform for trade credit and financing services within various industries. The company provides credit terms to businesses, enabling a frictionless checkout experience and real-time credit decision-making. Hokodo's solutions cater to sectors such as B2B marketplaces, food and beverages, agriculture, industrial supplies, construction and building materials, freight and logistics, freelance and workplace management, and corporate travel. It was founded in 2018 and is based in London, United Kingdom.

Fluid provides checkout solutions for B2B businesses. The company offers a range of flexible payment options, allowing buyers to either pay immediately or select credit terms that fit their specific needs. Fluid primarily serves the B2B sector in Asia. It was founded in 2023 and is based in Singapore.

Sprinque is a B2B crossborder payments platform that specializes in facilitating global expansion for businesses. The company offers a suite of payment solutions, including the ability for business buyers to pay by invoice with net payment terms or in installments, and provides merchants with instant payment while managing credit and fraud risks. Sprinque primarily serves businesses looking to streamline their payment processes and expand their customer base internationally. It was founded in 2021 and is based in Amsterdam, Netherlands.

Credit Key specializes in providing B2B credit solutions within the financial services sector. The company offers instant business credit at the point of purchase, enabling merchants to increase revenue and improve cash flow by providing their customers with flexible payment options such as net terms and pay over time. Credit Key primarily serves the eCommerce industry, offering a standalone module that integrates with various shopping cart platforms to facilitate real-time credit decisions and financing. It was founded in 2015 and is based in Los Angeles, California.

Slope specializes in B2B workflow automation within the financial technology sector. The company offers solutions for online payment processing, and flexible payment terms, and automates the entire order-to-cash cycle using its software and APIs. Slope primarily caters to businesses looking to streamline their financial operations and payment systems. It was founded in 2021 and is based in San Francisco, California.

Loading...