Uala

Founded Year

2017Stage

Series E - II | AliveTotal Raised

$1.039BLast Raised

$66M | 25 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+121 points in the past 30 days

About Uala

Uala provides a financial technology platform for the digital payment services sector. It offers a mobile application that allows users to manage their finances by purchasing, transferring, investing, and earning interest on their funds. It serves consumers looking for financial services. Uala was formerly known as Bancar Technologies. It was founded in 2017 and is based in Caba, Argentina.

Loading...

Uala's Products & Differentiators

Payments

We offer a core transactional product base which includes: bill payments, prepaid services, purchases, money transfers.

Loading...

Research containing Uala

Get data-driven expert analysis from the CB Insights Intelligence Unit.

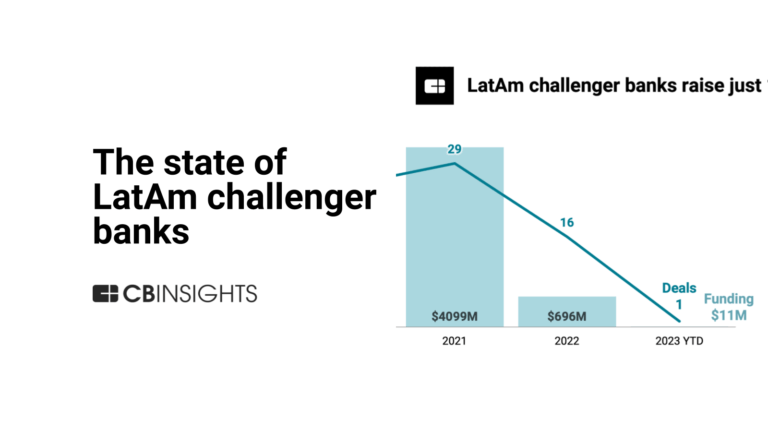

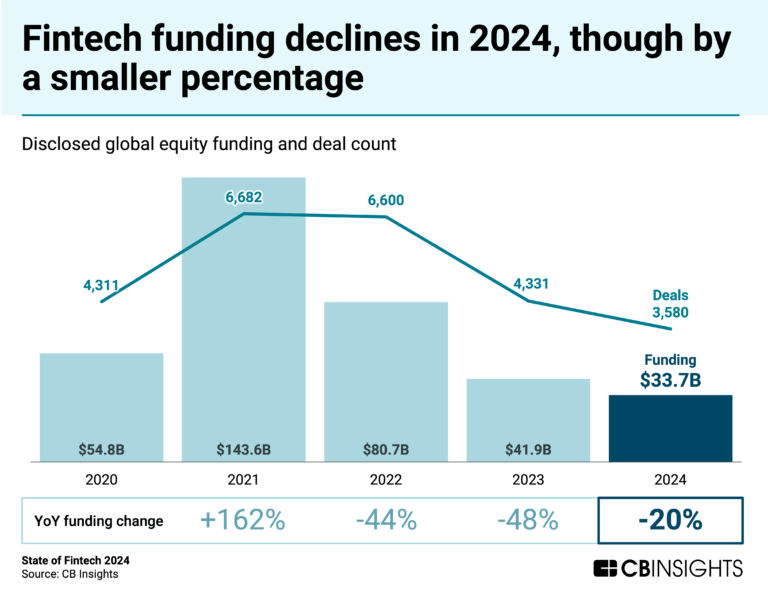

CB Insights Intelligence Analysts have mentioned Uala in 4 CB Insights research briefs, most recently on Jan 14, 2025.

Jan 14, 2025 report

State of Fintech 2024 Report

Expert Collections containing Uala

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uala is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,099 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Future Unicorns 2019

50 items

Fintech

13,699 items

Excludes US-based companies

Digital Banking

1,112 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Uala News

Mar 21, 2025

Uala Expands Series E Funding Round with TelevisaUnivision Investment Latin American fintech company Uala has successfully increased its Series E funding round by an additional $66 million, bringing the total to $366 million. This recent boost, as reported by Bloomberg , included significant participation from Mexican media giant TelevisaUnivision. The funds are earmarked for expansion across Latin America, particularly focusing on the Mexican market, according to CEO Pierpaolo Barbieri. The Series E round initially launched in November and has become one of the largest in the region in recent years, with the company's valuation reaching $2.75 billion at the first close. The initial phase was led by Allianz X, the venture capital arm of Allianz SE , and included notable investors such as Stone Ridge Holdings Group, Bill Ackman's Pershing Square Foundation, and billionaire Alan Howard. Barbieri highlighted the strategic importance of TelevisaUnivision, stating, "Televisa is a very relevant and influential outlet, across Spanish-speaking markets but especially in Mexico. It will help us create confidence and closeness with a lot of Mexicans that still don't know us." Uala, which began in Argentina in 2017 with a debit card offering, now provides a comprehensive suite of financial products including payments, credit, merchant acquiring, and investments, tailored to each country's needs. Currently, Uala boasts 9 million clients across Latin America, with 6.5 million in Argentina alone. The company is also experiencing rapid growth in Colombia, with monthly increases as high as 15%, and is considering further regional expansion or potential mergers and acquisitions. According to IndexBox data, the financial services market in Latin America is poised for significant growth, driven by the increasing digitization of financial services across the continent. This expansion aligns with Uala's strategy to capitalize on the underinvested financial landscape in the region, excluding Brazil, which already hosts numerous digital players. REPORT DESCRIPTION DATA-DRIVEN DECISIONS FOR YOUR BUSINESS GLOSSARY AND SPECIFIC TERMS KEY FINDINGS MARKET SIZE BEST-SELLING PRODUCTS 5. MOST PROMISING SUPPLYING COUNTRIES Choosing the Best Countries to Establish Your Sustainable Supply Chain TOP PRODUCING COUNTRIES Choosing the Best Countries to Boost Your Exports TOP CONSUMING MARKETS PRODUCTION VOLUME AND VALUE IMPORTS FROM 2012–2024 EXPORTS FROM 2012–2024 The Largest Producers on The Market and Their Profiles Market Value, 2012–2024 Production, In Physical Terms, By Country, 2012–2024 Imports, In Physical Terms, By Country, 2012–2024 Imports, In Value Terms, By Country, 2012–2024 Import Prices, By Country Of Destination, 2012–2024 Exports, In Physical Terms, By Country, 2012–2024 Exports, In Value Terms, By Country, 2012–2024 Export Prices, By Country Of Origin, 2012–2024 LIST OF FIGURES Market Value, 2012–2024 Market Value Forecast to 2030 Products: Market Size And Growth, By Type Products: Average Per Capita Consumption, By Type Products: Exports And Growth, By Type Products: Export Prices And Growth, By Type Production Volume And Growth Production, In Value Terms, 2012–2024 Production, By Country, 2024 Imports, In Physical Terms, 2012–2024 Imports, In Value Terms, 2012–2024 Imports, In Physical Terms, By Country, 2024 Imports, In Physical Terms, By Country, 2012–2024 Imports, In Value Terms, By Country, 2012–2024 Import Prices, By Country, 2012–2024 Exports, In Physical Terms, 2012–2024 Exports, In Value Terms, 2012–2024 Exports, In Physical Terms, By Country, 2024 Exports, In Physical Terms, By Country, 2012–2024 Exports, In Value Terms, By Country, 2012–2024 Export Prices, 2012–2024

Uala Frequently Asked Questions (FAQ)

When was Uala founded?

Uala was founded in 2017.

Where is Uala's headquarters?

Uala's headquarters is located at Nicaragua 4677, Caba.

What is Uala's latest funding round?

Uala's latest funding round is Series E - II.

How much did Uala raise?

Uala raised a total of $1.039B.

Who are the investors of Uala?

Investors of Uala include Allianz X, TelevisaUnivision, Soros Fund Management, Tencent, Ribbit Capital and 26 more.

Who are Uala's competitors?

Competitors of Uala include Aplazo, Albo, Stori, Neon, Klar and 7 more.

What products does Uala offer?

Uala's products include Payments and 3 more.

Loading...

Compare Uala to Competitors

Klar is a financial services company that offers credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Neon is a fintech company that provides digital banking services. The company offers a digital account, a credit card, CDBs, personal loans, and rewards, which can be accessed through a mobile application. Neon serves individual consumers and microentrepreneurs with its products. Neon was formerly known as ControlY. It was founded in 2016 and is based in Sao Paulo, Brazil.

Agibank is a financial institution that operates in the banking sector. The company offers a range of financial services, including personal loans, consigned loans, and investment services, all designed to facilitate the economic lives of its customers. It primarily serves individuals, offering solutions for various financial needs. It was founded in 1999 and is based in Campinas, Brazil.

Bnext operates as a financial technology company that offers a range of financial management services. The company provides an online banking platform with features such as international money transfers, virtual cards, expense tracking, and a marketplace for various financial products. Bnext also supports cryptocurrency transactions and integrates with mobile payment services. It was founded in 2016 and is based in Madrid, Spain.

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products, including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Digio is a digital banking platform that provides financial services. The company offers products including a digital bank account, credit card management, personal loans, and a rewards program, all accessible via a mobile application. Digio serves individuals who manage their finances through digital means. It was founded in 2013 and is based in Barueri, Brazil.

Loading...