Udaan

Founded Year

2016Stage

Series G | AliveTotal Raised

$2.115BValuation

$0000Last Raised

$75M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-23 points in the past 30 days

About Udaan

Udaan is a B2B e-commerce platform focused on the trade ecosystem for small businesses across various sectors. The company operates in categories such as FMCG, Staples, Fruits & Vegetables, and Pharma, providing a platform for supply chain and logistics operations. Udaan offers financial products and services through udaanCapital, addressing the working capital needs of small businesses, manufacturers, and retailers. It was founded in 2016 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Udaan

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Udaan in 2 CB Insights research briefs, most recently on Jan 31, 2024.

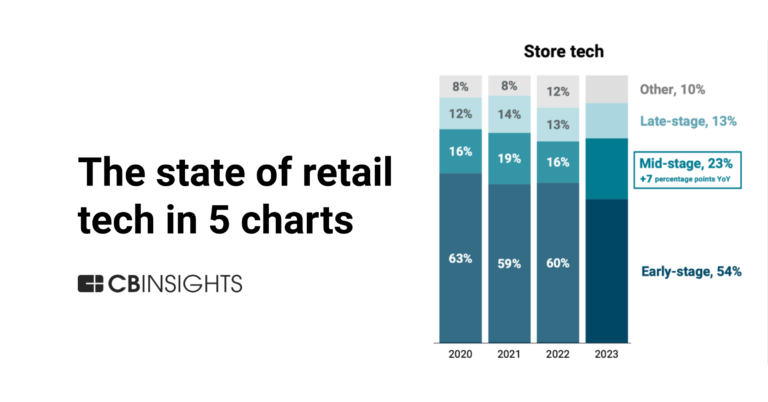

Jan 31, 2024

Retail tech in 5 charts: 2023Expert Collections containing Udaan

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Udaan is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,245 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

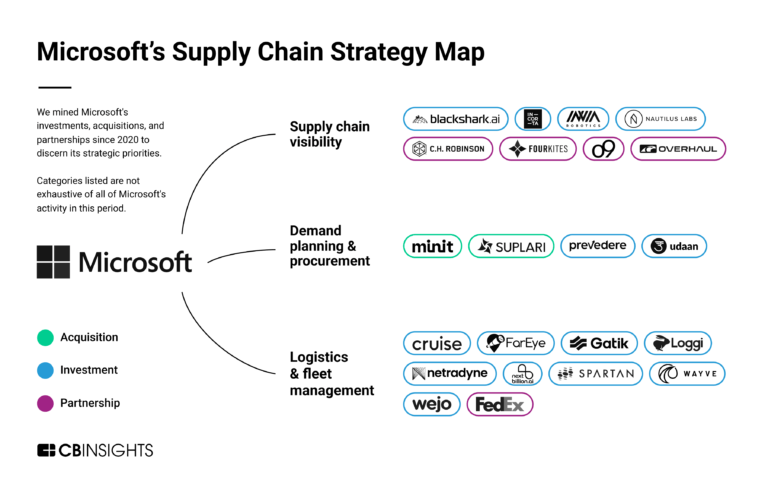

Supply Chain & Logistics Tech

4,391 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

SMB Fintech

1,231 items

Retail Tech 100

200 items

The most promising B2B tech startups transforming the retail industry.

Latest Udaan News

Apr 7, 2025

is advancing at an unprecedented pace across the startup ecosystem, with companies currently reporting automation levels between 15% and 50% and targeting 40% to 85% by the end of 2025. What once seemed like a distant vision has quickly become a strategic priority as startups adopt generative AI tools to reimagine the way software is written, tested, and deployed. From e-commerce and fintech to SaaS and AI, startups are racing to streamline development workflows, enhance productivity, and free up engineering teams to focus on higher-value innovation. Adtech firm InMobi is already halfway to its goal, having automated 50% of its software coding. CEO Naveen Tewari recently said in a LinkedIn post that the company is targeting 80% automation by the end of the year. B2B e-commerce platform Udaan is not far behind, with 90% of its front-end development and 30% to 50% of its back-end systems already automated. The company's senior vice president and head of engineering, K Siddhartha Reddy, told Fe that Udaan is empowering every developer with AI-driven tools to increase productivity ten-fold and redirect focus toward architecture, innovation, and user-centric problem solving. backed by WestBridge Capital, has integrated AI tools such as GitHub Copilot and Claude Code to automate 20% to 30% of routine coding tasks, such as writing boilerplate code, generating unit tests, and handling CRUD operations. The company is targeting 75% automation of undifferentiated code, including quality assurance, DevOps, and unit testing, and aims for 50% automation of core production code by the end of the year. Vikas Boggaram Setty, vice president of engineering at LeadSquared, said the company's strategy involves embedding generative AI throughout the software development life-cycle – from project planning to post-release analysis – using smarter models that can better interpret developer intent and integrate seamlessly into development environments. Conversational messaging platform Gupshup has automated 35% of its coding workflows and plans to scale that to 70-75% in the coming months. The company is focusing on early-stage testing, reusable code components, and expanding its use of AI-assisted development tools. Similarly, conversational AI startup CoRover has reached 40% automation, largely in repetitive code generation, testing, and deployment. Founder and CEO Ankush Sabharwal said CoRover's AI-powered framework, which uses natural language processing and machine learning, enables code synthesis, bug detection, and parts of the re-factoring process. The company expects to push automation to 65% by year-end by expanding model coverage to areas like AI-assisted code reviews, optimisation, and broader framework integration. Freshworks has also been reaping the benefits of AI in development. A recent company blog noted that its software engineers have seen a 30% reduction in coding time, and 61% reported improvements in code quality and a reduction in technical debt. GenAI startup Gnani AI has automated around 25% to 30% of its routine coding tasks and aims to raise that to 40% to 50% this year through a mix of internal models and external developer productivity tools. While high-growth and late-stage startups in traditionally tech-heavy sectors like SaaS and e-commerce are leading the push, other sectors are catching up. Education platform PhysicsWallah confirmed to Fe that it has made significant strides in automation, though it didn't disclose specific figures. Investment platform InvestorAi is currently at 15% automation and is running experiments with AI agents to automate large-scale updates. It aims to scale to 75% by the end of 2025. Despite the aggressive automation targets, startups emphasise that their goal is not to replace human developers. Instead, automation is being deployed to eliminate repetitive, low-value tasks so engineers can focus on critical thinking, user experience, and system optimisation. AI, they acknowledge, still lacks the nuanced understanding and contextual judgment needed for high-stakes or complex decision-making in software design. To support this shift, many companies are investing in reskilling programmes to transition developers into roles requiring deeper technical expertise, such as AI/ML engineering and solution architecture. Startups are also creating opportunities in emerging areas like AI ethics, model training, and collaborative workflows, with the broader goal of integrating automation in a way that enhances rather than displaces human talent.

Udaan Frequently Asked Questions (FAQ)

When was Udaan founded?

Udaan was founded in 2016.

Where is Udaan's headquarters?

Udaan's headquarters is located at 14th Main Sector 3, HSR Layout, Bengaluru.

What is Udaan's latest funding round?

Udaan's latest funding round is Series G.

How much did Udaan raise?

Udaan raised a total of $2.115B.

Who are the investors of Udaan?

Investors of Udaan include Lightspeed Venture Partners, M&G Investments, InnoVen Capital, Lighthouse Canton, Trifecta Capital and 27 more.

Who are Udaan's competitors?

Competitors of Udaan include SOLV, Infra.Market, CredAble, Flipkart, Lazada and 7 more.

Loading...

Compare Udaan to Competitors

Khatabook operates as a financial technology company that facilitates business management. It offers a software-as-a-service (SaaS) accounting platform for managing credit via a digital ledger application. It helps small and medium businesses with inventory management, billing and accounting, and tracking transactions. The company was founded in 2018 and is based in Bengaluru, India.

Digikala Group operates as an e-commerce organization. It focuses on multiple online industries. The company offers a wide range of services including online retail of consumer goods, fashion and apparel, digital content publishing, advertising, data analytics, financial technology, and logistics solutions. It primarily serves the e-commerce industry with its comprehensive suite of services designed to enhance the online shopping experience. It was founded in 2006 and is based in Tehran, Iran.

Dukaan is an online marketplace that provides tools for businesses to establish and manage their online stores. The company offers services including online store themes, payment gateway integration, and third-party plugins. Dukaan serves the ecommerce industry by providing solutions for order management, analytics, and multi-warehouse shipping. It was founded in 2020 and is based in Bengaluru, India.

Kaymu is an online shopping platform that provides products across various categories, including electronics, fashion, home appliances, and groceries. The company serves individual consumers and corporate clients. Kaymu was formerly known as Azmalo. It was founded in 2012 and is based in Karachi, Pakistan.

Dastgyr is a B2B e-commerce marketplace that provides a platform for buyers to access products from local and international sellers. The platform includes price comparisons and delivery options. Sellers can utilize services related to demand generation, payment processing, and logistics. Dastgyr serves sectors including FMCG, construction, chemicals, and agricultural goods. It was founded in 2020 and is based in Karachi, Pakistan.

Bikayi is a comprehensive e-commerce enabler that specializes in providing a platform for businesses to create and manage their online stores. The company offers a suite of services including customizable store themes, integrated payment gateways, multi-vendor support, and delivery partner integration, as well as advanced features for digital marketing, SEO, and social media engagement. Bikayi's solutions cater to a wide range of sectors, including food and beverages, jewelry, fashion, electronics, and groceries, enabling entrepreneurs and startups to scale their online presence and sales. It was founded in 2019 and is based in Gachibowli, India.

Loading...