Uniswap

Founded Year

2017Stage

Unattributed VC | AliveTotal Raised

$178.83MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-5 points in the past 30 days

About Uniswap

Uniswap is a decentralized finance platform that operates in the cryptocurrency sector. It provides a protocol for trading, earning, and liquidity provision without a central intermediary. The platform supports a growing network of DeFi applications and offers tools for developers to build on its protocol. It was founded in 2017 and is based in Brooklyn, New York.

Loading...

ESPs containing Uniswap

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

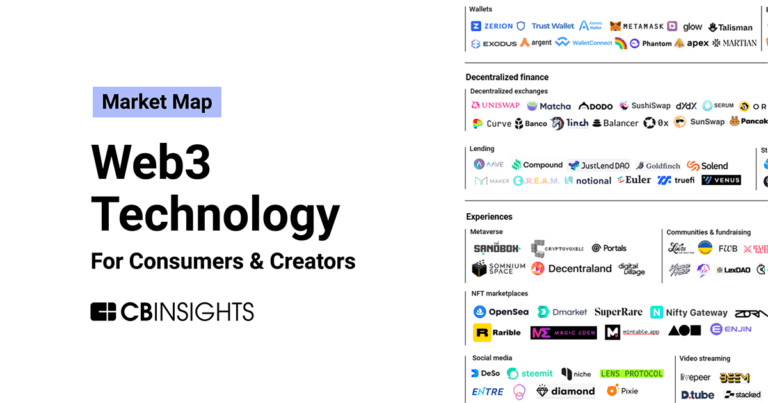

The decentralized crypto exchanges market refers to a segment of the cryptocurrency industry that aims to provide individuals with access to trading digital assets without the need for centralized entities or KYC disclosures. These exchanges offer professional trading tools for institutions and professional traders while allowing users to maintain custody of their own funds, which is unique compar…

Uniswap named as Leader among 8 other companies, including dYdX, 1inch Network, and Balancer.

Loading...

Research containing Uniswap

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uniswap in 3 CB Insights research briefs, most recently on Feb 20, 2025.

Oct 15, 2022

What is institutional staking?Expert Collections containing Uniswap

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uniswap is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

13,201 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

50 items

Latest Uniswap News

Apr 12, 2025

Potential increase in crypto market activity and volume. Mark Uyeda, acting chair of the SEC, revealed plans to establish a regulatory sandbox for digital assets, enabling exchanges like Coinbase to explore new avenues, including tokenized securities trading. The initiative could redefine blockchain innovation in the U.S., offering exchanges a chance to trial new models with reduced regulatory burdens. SEC's New Regulatory Sandbox to Foster Blockchain Innovation Mark Uyeda of the SEC disclosed a regulatory sandbox approach during a recent roundtable, encouraging blockchain advancements by easing restrictions on crypto exchanges. This setup promises a “time-limited, conditional exemption relief framework” to innovate in tokenized securities trading. Industry stalwarts, including Coinbase and Uniswap Labs , participated in discussions supporting this move. A key change with this approach is the relaxation of regulatory constraints, fostering an open environment for creating and testing digital asset solutions. By offering exemption relief , the SEC aims to boost technological growth and stimulate market participation without fear of premature enforcement actions. Industry reactions have been overwhelmingly positive, with stakeholders appreciating the SEC's attempt at creating a supportive setting for innovation. Mark Uyeda emphasized the importance of innovation by stating, “I encourage market participants developing new ways to trade securities using blockchain technology to provide input on what exemptions may be applicable.” Hester Peirce, SEC Commissioner, reaffirmed the need for a “clear, sensible, and fair path”. U.S. Market Poised for Growth Amid SEC Sandbox Plans Did you know? The UK tested similar digital securities sandboxes, paralleling the SEC's initiative, offering insights into potential U.S. market outcomes. USDC, currently valued at $1.00, holds a market cap of $60.07 billion and a market dominance of 2.28%, according to CoinMarketCap data on April 12, 2025. Trading volume fell by 15.61% to $11.016 billion. In the past 90 days, USDC saw a price change of 0.01%. USDC(USDC), daily chart, screenshot on CoinMarketCap at 00:37 UTC on April 12, 2025. Source: CoinMarketCap Coincu analysts suggest that regulatory sandboxes could accelerate DeFi integration of tokenized securities, increasing liquidity and expanding governance token use. These actions may strengthen the U.S. position as a leader in blockchain innovations if successful. Source: https://coincu.com/331673-sec-regulatory-sandbox-digital-assets/

Uniswap Frequently Asked Questions (FAQ)

When was Uniswap founded?

Uniswap was founded in 2017.

Where is Uniswap's headquarters?

Uniswap's headquarters is located at 181 North 11th Street, Brooklyn.

What is Uniswap's latest funding round?

Uniswap's latest funding round is Unattributed VC.

How much did Uniswap raise?

Uniswap raised a total of $178.83M.

Who are the investors of Uniswap?

Investors of Uniswap include FJ Labs, Paradigm, SV Angel, Variant Fund, Polychain Capital and 11 more.

Who are Uniswap's competitors?

Competitors of Uniswap include vlayer, LunarCrush, Vertex Protocol, Injective, DODO Exchange and 7 more.

Loading...

Compare Uniswap to Competitors

Curve Finance creates an exchange liquidity pool on Ethereum designed for: extremely efficient stablecoin trading, low risk, supplemental fee income for liquidity providers, without an opportunity cost.

GMX is a decentralized perpetual exchange operating in the cryptocurrency sector. The company enables trading of spot or perpetual contracts for top cryptocurrencies like BTC, ETH, and AVAX with leverage options up to 50x, directly from a user's wallet on the Arbitrum and Avalanche networks. It was founded in 2021 and is based in Singapore, Singapore.

GMX is an internet company that focuses on providing email services. The company offers free email accounts that are designed for both personal and professional use. Its primary sector is the internet services industry. It is based in Karlsruhe, Germany.

Primex Finance is a non-custodial prime brokerage protocol operating in the decentralized finance sector. The company offers leveraged spot trading on decentralized exchanges (DEXs) with advanced trading tools and cross-chain balance transfer capabilities, without the need for traditional intermediaries. Primex Finance integrates with multiple DEXs and provides a platform for users to trade a variety of assets using leverage backed by lenders. It was founded in 2021 and is based in Tallinn, Estonia.

Messari is a cryptocurrency research startup that provides data services and market intelligence in the blockchain and cryptocurrency sectors. The company offers data ingestion and analysis services to support token projects, exchanges, and information service providers. Messari's market intelligence services are designed to monitor cryptocurrency circulation and provide insights into the crypto economy. It was founded in 2017 and is based in New York, New York.

ZKX is a company that focuses on decentralized finance, specifically in the domain of perpetual futures trading. The company offers a decentralized exchange (DEX) on Starknet that allows users to trade perpetual futures securely while retaining ownership of their funds. Users can also earn rewards by trading and staking on ZKX, and the platform features community governance. The company primarily serves the financial technology industry. It was founded in 2021 and is based in Dubai, United Arab Emirates.

Loading...