Unqork

Founded Year

2017Stage

Series C | AliveTotal Raised

$367.17MValuation

$0000Last Raised

$207M | 5 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-91 points in the past 30 days

About Unqork

Unqork focuses on providing a codeless application development platform for the enterprise sector. Its main offerings include a visual designer for creating complex, mission-critical enterprise applications without the need for traditional coding. The company primarily serves sectors such as financial services, insurance, government, and healthcare. It was founded in 2017 and is based in New York, New York.

Loading...

Loading...

Research containing Unqork

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Unqork in 9 CB Insights research briefs, most recently on Dec 18, 2023.

Dec 18, 2023

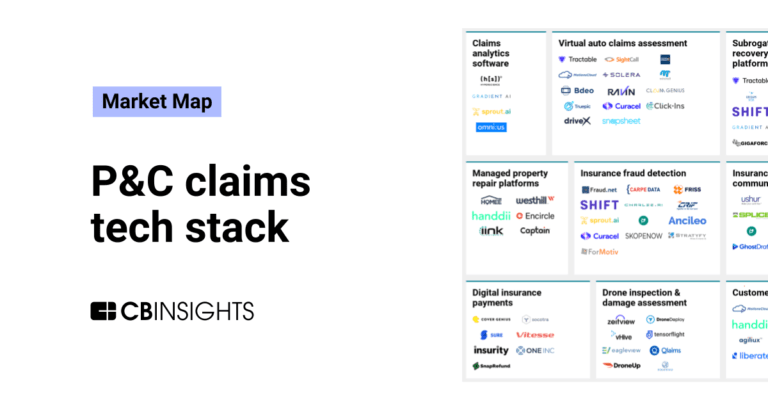

The P&C claims tech stack market map

Nov 10, 2023

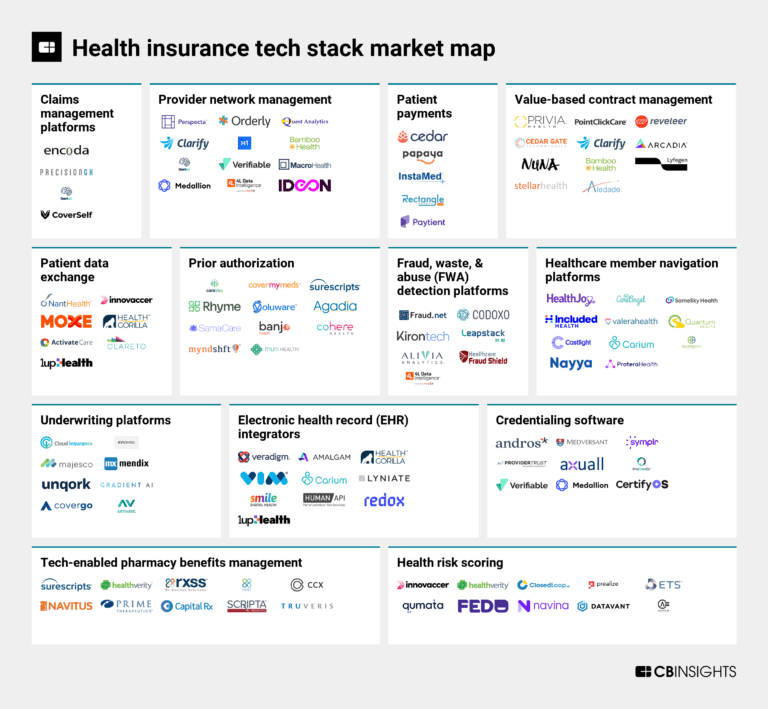

The health insurance tech stack market map

Apr 20, 2022 report

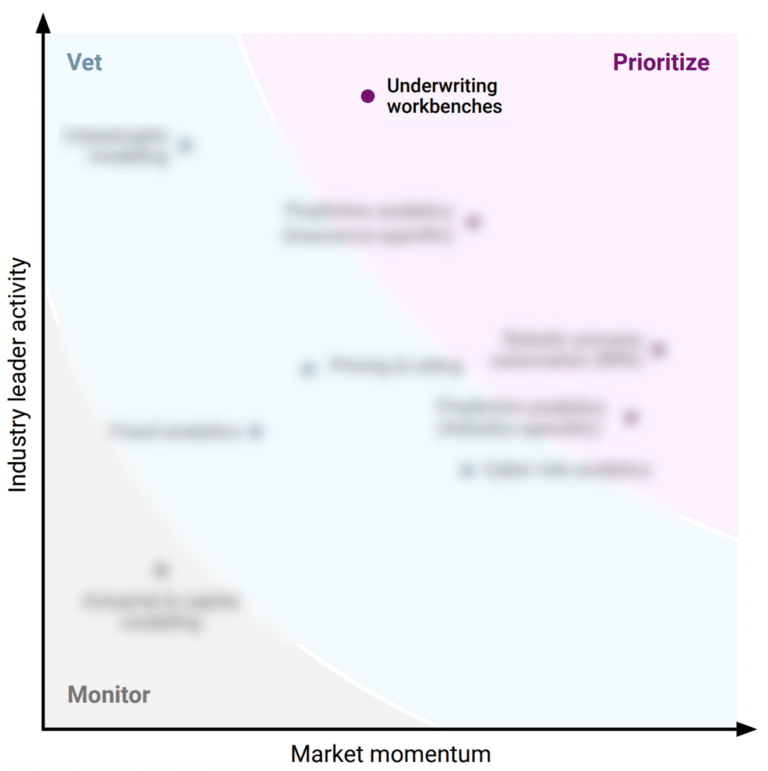

Why P&C insurance underwriters are prioritizing underwriting workbenchesExpert Collections containing Unqork

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Unqork is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Capital Markets Tech

1,163 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Robotic Process Automation

322 items

RPA refers to the software-enabled automation of data-intensive tasks that are low-skill but highly sensitive operationally, including data entry, transaction processing, and compliance.

Insurtech

4,483 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Unqork Patents

Unqork has filed 4 patents.

The 3 most popular patent topics include:

- software design patterns

- web frameworks

- cloud platforms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/2/2018 | 5/9/2023 | Web frameworks, Graphical user interfaces, Integrated development environments, Java platform, Agile software development | Grant |

Application Date | 7/2/2018 |

|---|---|

Grant Date | 5/9/2023 |

Title | |

Related Topics | Web frameworks, Graphical user interfaces, Integrated development environments, Java platform, Agile software development |

Status | Grant |

Latest Unqork News

Oct 30, 2024

News provided by Share this article Unqork's Underwriting Workbench solution was recognized for its advanced decisioning tools and strong efficiency features. NEW YORK, Oct. 30, 2024 /PRNewswire/ -- Unqork, the leading Enterprise App Cloud, today announced its placement in the top quadrant of Celent's latest report, Unlocking Underwriting Success, Global Edition: The Rise of Underwriting Workbenches. The report highlights underwriting solutions with advanced decisioning tools and strong efficiency features. Unqork's Underwriting Workbench, one of the only cross-industry solutions in Celent's report, was highlighted for its innovative approach to underwriting, offering P&C carriers advanced technology to streamline and enhance their underwriting processes without the burden of technical debt. Beyond insurance, Unqork's Underwriting Workbench exemplifies the power of the Unqork platform, delivering a best-in-class solution and enabling enterprises to transform critical business processes quickly and efficiently – all without the burden of code maintenance. Unqork's unique horizontal platform drives innovation without the burden of technical debt across financial services, government, and healthcare sectors, combining deep industry expertise with flexible, scalable solutions that cater to diverse customer needs. Unqork's Underwriting Workbench allows companies to launch sophisticated, customized products and streamline the underwriting process—from intake to bind—in just a few weeks, without writing a single line of code. "Unqork's Underwriting Workbench exemplifies our commitment to rapid innovation in insurance technology. This recognition highlights our dedication to empowering underwriters with a streamlined platform that boosts efficiency, accelerates speed to market, and enhances the overall customer experience," said Chandresh Kothari (CK), Global Head of Insurance and Healthcare at Unqork. Unqork automates manual tasks and integrates an underwriter workstation, allowing insurers to focus on new business opportunities while scaling as risks evolve. It streamlines data integration for better decision-making, with built-in controls, audit trails, and a modern self-service UI enhancing experiences and reducing costs and risk. "We are thrilled that Unqork has been ranked in the top quadrant of Celent's Underwriting Workbench Report," said Thierry Bonfante, Chief Product and Technology Officer of Unqork. "Our solution unlocks innovation and drives new business by overcoming the most persistent challenges underwriters face, from siloed and consistent data to inflexible legacy systems and disconnected underwriting experiences." Learn more: About Unqork Unqork, the first Enterprise App Cloud solution, is reshaping how organizations build, maintain, and secure the entire lifecycle of their applications in the cloud—all with zero code. Unqork provides industry-tailored solutions for customers in financial services, insurance, government, and healthcare – empowering enterprises to unleash business agility while removing the burden of technical debt. Unqork's customers include Goldman Sachs, Marsh, BlackRock, and the U.S. Department of Health and Human Services. To learn more, visit: https://www.unqork.com SOURCE Unqork

Unqork Frequently Asked Questions (FAQ)

When was Unqork founded?

Unqork was founded in 2017.

Where is Unqork's headquarters?

Unqork's headquarters is located at 85 5th Avenue, New York.

What is Unqork's latest funding round?

Unqork's latest funding round is Series C.

How much did Unqork raise?

Unqork raised a total of $367.17M.

Who are the investors of Unqork?

Investors of Unqork include BlackRock, CapitalG, Aquiline Capital Partners, Broadridge Financial Solutions, Goldman Sachs and 12 more.

Who are Unqork's competitors?

Competitors of Unqork include Decimal Technologies, Federato, Planck, UniBlox, Inari and 7 more.

Loading...

Compare Unqork to Competitors

Convr specializes in AI-driven underwriting analysis for the commercial property and casualty (P&C) insurance sector. The company offers a modular end-to-end underwriting management platform that processes commercial insurance data, automates risk assessment, and supports underwriting decisions with a patented AI decisioning engine. Convr's platform is designed to enhance underwriting productivity, improve risk classification accuracy, and streamline the submission intake process. It was founded in 2015 and is based in Schaumburg, Illinois.

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. The company's main service is an artificial intelligence (AI)-powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Cytora specializes in the digitization of commercial insurance workflows and operates within the insurance technology sector. The company offers a platform that digitizes incoming risks, augments them with additional data, evaluates them against various business rules, and routes them to appropriate systems for underwriting. Cytora's platform is designed to improve premium growth, profitability, and service in the commercial and specialty insurance segments by streamlining core underwriting processes and enabling data-driven decision-making. Cytora was formerly known as Bisomotion Ltd. It was founded in 2014 and is based in London, United Kingdom.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Sixfold provides generative AI tools for the insurance underwriting sector. Its platform ingests underwriting guidelines, extracts relevant risk data, and offers risk insights and suggestions. The company serves insurers, managing general agents (MGAs), and reinsurers across various lines of insurance including life, disability, and property & casualty. It was founded in 2023 and is based in New York, New York.

SortSpoke provides document processing solutions for the insurance industry, focusing on underwriting efficiency through AI. The company offers solutions that automate the triage and data extraction process for insurance submissions, allowing underwriters to process submissions with improved accuracy. SortSpoke's platform is aimed at business users, enabling template-free, no-code data extraction and human-in-the-loop review for data quality assurance. It was founded in 2017 and is based in Toronto, Ontario.

Loading...