Upgrade

Founded Year

2016Stage

Series F | AliveTotal Raised

$550.5MValuation

$0000Last Raised

$280M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About Upgrade

Upgrade specializes in personal loans and credit card products. The company offers financial services including personal loans, credit card options, and savings accounts. Upgrade primarily serves individuals seeking solutions such as debt consolidation, home improvements, or major purchases. It was founded in 2016 and is based in San Francisco, California.

Loading...

ESPs containing Upgrade

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The home improvement financing market encompasses a variety of financial solutions designed to fund home renovation, remodeling, or improvement projects. It offers homeowners the means to enhance the value, functionality, and aesthetics of their properties without depleting their savings. Home improvement financing solutions may include home equity loans, lines of credit, personal loans, or specia…

Upgrade named as Challenger among 12 other companies, including SoFi, LendingClub, and Prosper.

Upgrade's Products & Differentiators

Upgrade Card

Upgrade Card is the only credit card that is "good for you": it comes with low-cost credit and helps consumers pay down their balance faster

Loading...

Research containing Upgrade

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Upgrade in 2 CB Insights research briefs, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Upgrade

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Upgrade is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

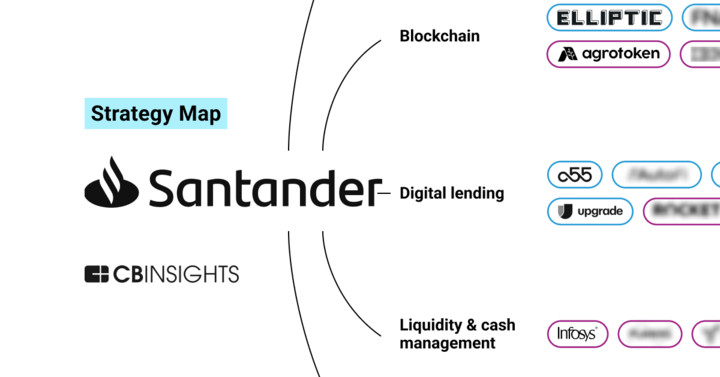

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Future Unicorns 2019

50 items

Upgrade Patents

Upgrade has filed 4 patents.

The 3 most popular patent topics include:

- assisted reproductive technology

- battery charging

- battery electric cars

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | 9/17/2024 | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Human reproduction | Grant |

Application Date | 10/20/2022 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Human reproduction |

Status | Grant |

Latest Upgrade News

Mar 31, 2025

Ben Metz on modernizing banking technology Ben Metz, CTO of Jack Henry, offered a candid look at the underlying issues plaguing legacy core banking systems — and what it will take to modernize them. “It’s mind-boggling how complex these systems are,” he said, describing layers of interdependent processes that ultimately reach the system of record. According to Metz, most core banking systems operate like a distributed database, just without any synchronization protocols. “Every bank in the United States stops the world and runs what they call end-of-day or good night processes,” he explained. “That is exactly where all the complexity is for every single product that ever tries to get built.” This lack of real-time state awareness, he noted, leads to additional layers of technical complexity as institutions attempt to work around the limitations. Yet “if you just take it all the way down to the journal level, you can rebuild these systems back up in a much simpler way. My hot take is it’s actually not too hard to rebuild these systems if you just think about them differently.” Jackie Reses on building trust with regulators Jackie Reses, CEO and cofounder of Lead Bank, shared strategies for navigating regulatory relationships. Her approach emphasizes transparency and consistent engagement. “We’re really proactive,” she said. “We go to regulators with new products. We make sure they know about new clients.” Reses noted the advantage of working with the FDIC at the local level: Lead’s Kansas City-based regulators know them professionally and around the community. This regular, local connection creates trust. Lead is also hands-on in educating regulators. Reses described how her team works closely with the FDIC, the Federal Reserve, and members of Congress to distinguish between “good actors and bad actors.” “Because they know us, they trust us and see the quality and consistency of our compliance work,” she said. That visibility has allowed her team to work through complex regulatory issues with credibility. Why some fintech companies are choosing not to become a bank Despite the rise of global neobanks like Revolut ($45B+ market cap) and Nubank ($50B+ market cap), the U.S. has yet to produce a homegrown neobank of a similar scale with its own banking license. But according to Renaud Laplanche, CEO and cofounder of Upgrade, not having a banking license may not be a disadvantage. “I wouldn’t necessarily agree that you get lower cost of funding or better economics or a marketing advantage by saying you’re a bank. Maybe that was the case 10 years ago. I don’t think it is now,” he said. He drew a distinction between full bank ownership and lighter regulatory frameworks like an ILC or fintech charter. “You lose a lot of your freedom to operate [as a bank],” he explained. “You add friction and capital requirements that you don’t have when you operate as a pure marketplace. I love having the freedom to focus on product innovation, marketing, consumer experience, and capital markets, but really outsource the balance sheet to someone else.” One of those partners is Cross River Bank, which powers Upgrade’s banking infrastructure. Gilles Gade, CEO and founder of Cross River, described the bank’s role as deeply embedded in its fintech partners’ operations. “[We] insert ourselves in the life cycle of our partners, to the best of our ability, to become the experts in areas where they don’t need to,” he said, referencing common pain points like capital markets and compliance. Gade also noted that acquiring or becoming a bank can invite tight regulatory oversight or even trigger de novo rules that may restrict growth to 20% annually for up to seven years — an unrealistic restraint for venture-backed fintech companies. From his perspective, it’s more efficient to partner with a bank capable of supporting the fintech company’s ability to scale for the majority of the stack, at a manageable price point, and grow together. Recent M&A deals and market intel Klarna’s IPO filing flipped public on Friday, though it didn’t disclose the number of shares to be offered or the expected price range. A Bloomberg article from earlier this month stated that the company is reportedly seeking to raise at least $1B, with an aim to price the IPO in early April. Amex acquires Center: Amex announced its acquisition of Center, a travel and expense management company, reportedly for $600M. The business was led by Steve Singh (founder of Concur and executive chairman of Center) and his son, Naveen Singh (Center’s CEO). Bilt acquires Banyan: Bilt announced its acquisition of Banyan, intended to accelerate Bilt’s expansion into new merchant categories and create a comprehensive neighborhood commerce network. Banyan is an existing vendor to Bilt, powering its FSA/HSA program at Walgreens. Following the acquisition, Banyan will continue to operate independently, maintaining its existing client relationships and services, while collaborating closely with Bilt. Clearwater Analytics acquires Beacon and Blackstone’s Bistro: Clearwater announced its acquisition of Beacon, a cross-asset class modeling and risk analytics platform, for ~$560M (60% in cash). Beacon had ~$44M ARR at the end of 2024. Clearwater also announced its acquisition of Bistro, Blackstone’s portfolio visualization software built for its Credit and Insurance business, for $125M ($10M paid in cash). This is all in addition to the company’s potential Enfusion acquisition. which is in process. Morningstar acquires Lumonic and DealX: Morningstar announced the acquisitions of Lumonic, a private credit portfolio monitoring and management platform, and DealX, a provider of U.S. commercial mortgage-backed security (CMBS) and (collateralized loan obligation) CLO data. Lumonic will remain a standalone product, armed with PitchBook’s resources. Want more a16z Fintech? The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/ . Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information. Want more a16z Fintech?

Upgrade Frequently Asked Questions (FAQ)

When was Upgrade founded?

Upgrade was founded in 2016.

Where is Upgrade's headquarters?

Upgrade's headquarters is located at 275 Battery Street, San Francisco.

What is Upgrade's latest funding round?

Upgrade's latest funding round is Series F.

How much did Upgrade raise?

Upgrade raised a total of $550.5M.

Who are the investors of Upgrade?

Investors of Upgrade include Ribbit Capital, VY Capital, Sands Capital, Ventura Capital, G Squared and 19 more.

Who are Upgrade's competitors?

Competitors of Upgrade include Tala, Best Egg, Kissht, Prodigy Finance, Conductiv and 7 more.

What products does Upgrade offer?

Upgrade's products include Upgrade Card and 2 more.

Loading...

Compare Upgrade to Competitors

Tala provides digital financial services. The company offers a money app that facilitates access to credit, payments, savings, and transfers, utilizing artificial intelligence (AI) and machine learning to create financial experiences. Tala primarily serves individuals seeking services beyond traditional banking. It was founded in 2011 and is based in Santa Monica, California.

Branch International provides digital banking services. The company offers financial products including loans, money transfers, bill payments, investments, and savings, accessible through a smartphone app. Branch serves individuals in emerging markets. It was founded in 2015 and is based in Mumbai, India.

Prodigy Finance specializes in education loans for international students pursuing master's degrees. The company offers collateral-free loans to cover tuition and living expenses, aimed at students who wish to study abroad without the need for a co-signer or collateral. Prodigy Finance primarily serves the higher education sector, facilitating access to top-tier educational institutions globally. It was founded in 2007 and is based in London, United Kingdom.

Brighte is a financial services company that offers financing solutions for solar panels, energy-efficient home products, and electrification services, serving homeowners interested in sustainable energy technologies. It was founded in 2015 and is based in Sydney, Australia.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Avant is a financial technology company that specializes in providing personal loans and credit cards. The company offers a range of financial solutions designed to help individuals manage their finances and achieve their personal goals. Avant primarily serves consumers looking for credit and loan products to support their financial needs. It was founded in 2012 and is based in Chicago, Illinois.

Loading...