Uplift

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$292.7MValuation

$0000About Uplift

Uplift develops a fintech marketing platform for traveling purposes. The platform offers a buy now pay later scheme for travel through its partner websites and avails a range of payment plans. The company was founded in 2014 and is based in Sunnyvale, California. In July 2023, Uplift was acquired by Upgrade.

Loading...

Uplift's Product Videos

ESPs containing Uplift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Uplift named as Challenger among 15 other companies, including PayPal, Affirm, and Klarna.

Uplift's Products & Differentiators

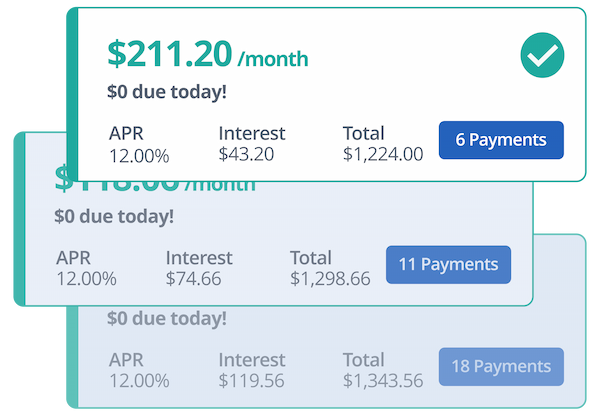

Pay Over Time

Monthly installment plan from 3 - 24 months with consumer funded interest from 7% - 36%. Min installment amount $100, maximum installment amount $25,000.

Loading...

Research containing Uplift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uplift in 1 CB Insights research brief, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Uplift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uplift is included in 5 Expert Collections, including Travel Technology (Travel Tech).

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Digital Lending

2,577 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Uplift Patents

Uplift has filed 14 patents.

The 3 most popular patent topics include:

- analog circuits

- electric power conversion

- electronic amplifiers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/15/2021 | 9/3/2024 | Semiconductor lasers, Total solar eclipses, Solar phenomena, Machine learning, Irregular military | Grant |

Application Date | 4/15/2021 |

|---|---|

Grant Date | 9/3/2024 |

Title | |

Related Topics | Semiconductor lasers, Total solar eclipses, Solar phenomena, Machine learning, Irregular military |

Status | Grant |

Latest Uplift News

Apr 9, 2025

10 best buy now pay later apps like Afterpay to watch in 2025 Copied As the Buy Now, Pay Later (BNPL) market comes of age in 2025, consumers and merchants alike are reconsidering their financial instruments. What was once seen as an innovative payment method, BNPL is now a mainstream payment across , travel, and even brick-and-mortar retail. Afterpay may have pioneered the model, but the market is now more competitive than ever before, with new entrants resetting flexibility, access, and trust in digital payments. Changes in spending patterns, increased regulation, and pressure for credit-building functionality have contributed to a surge in new entrants providing functionality to match various consumer demands. This top 10 list of Afterpay competitors, not sorted by popularity or performance, depicts 10 leading platforms transforming BNPL in 2025, each bringing differentiated value propositions to global and regional markets. Klarna Klarna has expanded quickly through North America and Europe, providing flexible payment offerings ranging from ‘Pay in 4’ to long-term credit. Its intuitive interface and embedded shopping browser distinguish it, while its extension into lifestyle content continues the convergence of commerce and convenience. Klarna is still a reigning force behind casual buys and luxury indulgences. Affirm Affirm has established itself on trust and financial transparency. Most BNPL players do not charge fixed monthly payments and reveal interest charges before agreeing to a deal. Partnering with big players like Amazon and Peloton highlights its dominance in high-ticket financing. Affirm’s lack of late fees gives it an added layer of customer trust for consumers who hate surprise charges. Simpl Simpl has one-tap checkout in India, cringing together purchases made on multiple platforms into a bi-weekly payment cycle. With no interest and low entry thresholds, it has become entrenched in India’s fast-digitising retail economy. Simpl’s mobile-first design aligns with a generation that loves speed and convenience over conventional PayPal Pay Later Capitalising on one of the most trusted digital wallets globally, PayPal Pay Later provided short-term installment options that easily work with current PayPal accounts. It enables customers to pay in four interest-free payments over approximately six weeks, typically. Wide acceptance by merchants and security controls make this solution a top option in PayPal’s massive user base. Sezzle Sezzle combines a dedication to financial education with installment payments. Sezzle Up, its most notable function, helps customers create their credit profiles by reporting payment histories to credit bureaus. The ability to reschedule a payment without penalty further reinforces its focus on responsible lending. Sezzle continues to find favour among Gen Z and Zip Zip, formerly known as Quadpay, allows customers to split payments into fortnightly installments, backed by a virtual card that can be used at most online retailers. This flexibility also applies to in-store spending through Apple Pay and Google Pay. Zip’s rebranding mirrors its global aspirations, with businesses operating across Australia, the US, and other burgeoning BNPL regions. Splitit Spilitit follows a different path by using the customer’s current credit line instead of providing new credit. It pre-authorises the purchase amount and funds are released as payments are processed. This structure avoids applications or hard credit checks, which will be attractive to consumers who value simplicity and keeping their financial footprint low. Laybuy Breaking payments into six installments spaced within a six-week duration, Laybuy makes minor credit checks to qualify. Already operating in the UK, Australia, and New Zealand, it is now able to provide a real-time spending allowance and automatic deductions from actual spending budgets to assist shoppers in developing disciplined shopping habits. This trend is benefiting from Transparency that allows low fees and a simple process to build loyalty among price-cautious customers. Uplift Uplift serves the travel sector, which is occasionally overlooked by traditional BNPL suppliers. It offers payment plans for vacation reservations through partnerships with airlines, cruise lines, and online travel agencies. Uplift is a vital resource for aspirational but budget-conscious tourists because it offers fixed monthly rates and no late fees. With global travel on the rise, Uplift has room to expand. LazyPay

Uplift Frequently Asked Questions (FAQ)

When was Uplift founded?

Uplift was founded in 2014.

Where is Uplift's headquarters?

Uplift's headquarters is located at 440 N. Wolfe Road, Sunnyvale.

What is Uplift's latest funding round?

Uplift's latest funding round is Acquired.

How much did Uplift raise?

Uplift raised a total of $292.7M.

Who are the investors of Uplift?

Investors of Uplift include Upgrade, Atalaya Capital Management, Paycheck Protection Program, PAR Capital, Ridge Ventures and 11 more.

Who are Uplift's competitors?

Competitors of Uplift include Kadogo and 7 more.

What products does Uplift offer?

Uplift's products include Pay Over Time and 1 more.

Loading...

Compare Uplift to Competitors

Zilch provides buy now pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the ecommerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Anyday is a financial technology company specializing in consumer finance solutions within the retail sector. The company offers services that allow customers to split their purchases into multiple payments without interest or fees. Anyday primarily serves the ecommerce industry, providing payment options to consumers at various online stores. It was founded in 2020 and is based in Denmark.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

Butter focuses on financial services in the e-commerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the e-commerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, United Kingdom.

Partial.ly is a business focused on providing payment plan software within the financial technology sector. The company offers installment payment solutions for e-commerce and invoicing, allowing customers to pay at their own pace. Partial.ly primarily serves the e-commerce and invoicing sectors. It was founded in 2015 and is based in Tampa, Florida.

Loading...