Uptake

Founded Year

2014Stage

Incubator/Accelerator - II | AliveTotal Raised

$317MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+9 points in the past 30 days

About Uptake

Uptake specializes in industrial intelligence and predictive analytics within the software-as-a-service (SaaS) sector. The company offers solutions that translate data into insights for predictive maintenance, asset failure prediction, and optimization of maintenance strategies. Uptake primarily serves sectors that require maintenance analytics, such as transportation and heavy industry. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing Uptake

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The oil & gas asset management solutions market helps monitor, maintain, and optimize the physical assets used in the exploration, production, and transportation of oil and gas. These solutions include software platforms for predictive maintenance, remote monitoring systems, digital twins, field service management, and analytics tools that process operational data. Companies in this market serve o…

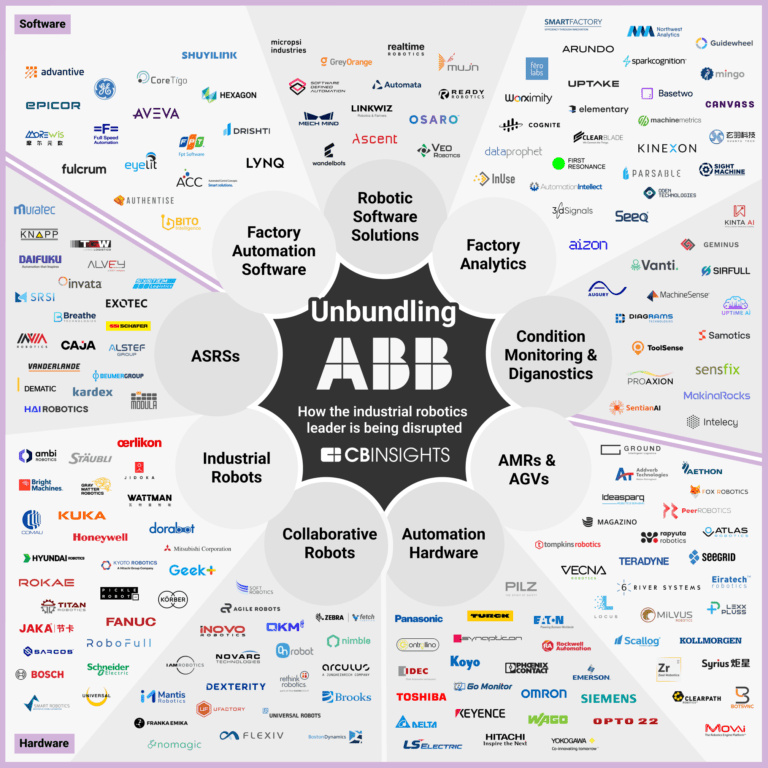

Uptake named as Outperformer among 15 other companies, including IBM, ABB, and Emerson.

Uptake's Products & Differentiators

Uptake Fusion

Uptake Fusion streamlines movement, storage, and curation of OT data, accelerating the transfer to the cloud while ensuring data integrity and security. The data is organized in the customer’s cloud environment on Microsoft Azure. Users across an organization, from multiple business units, have free rein to analyze the data, model the data, and customize it for a wide range of use cases that suit their specific needs.

Loading...

Research containing Uptake

Get data-driven expert analysis from the CB Insights Intelligence Unit.

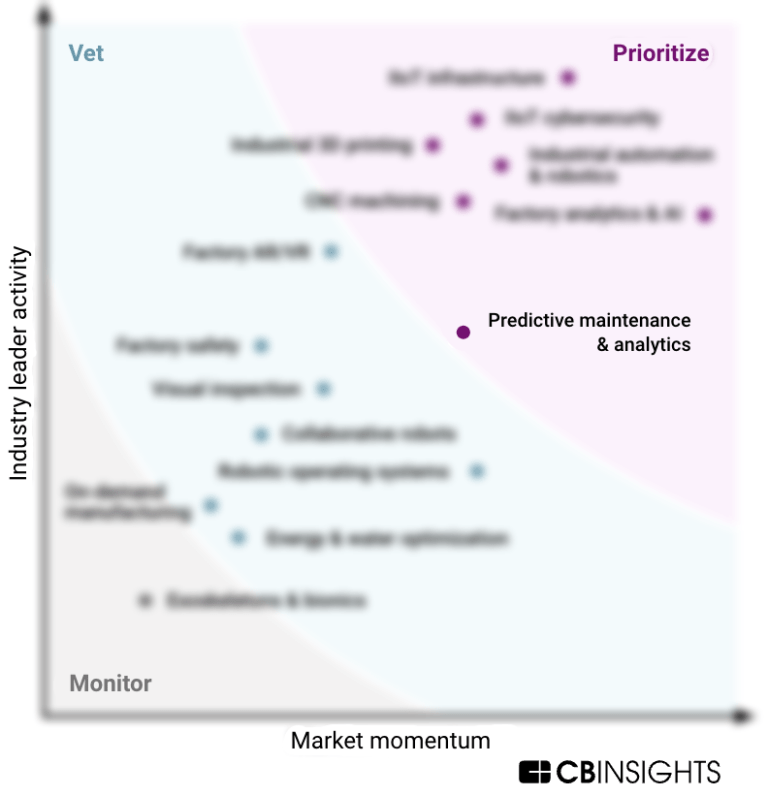

CB Insights Intelligence Analysts have mentioned Uptake in 6 CB Insights research briefs, most recently on Mar 21, 2024.

Aug 16, 2023

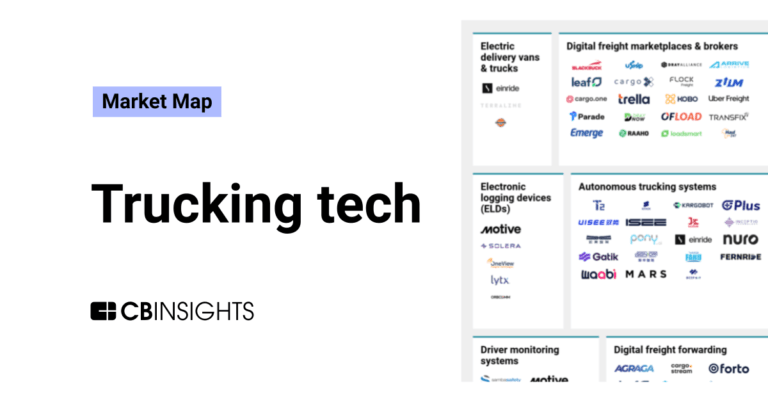

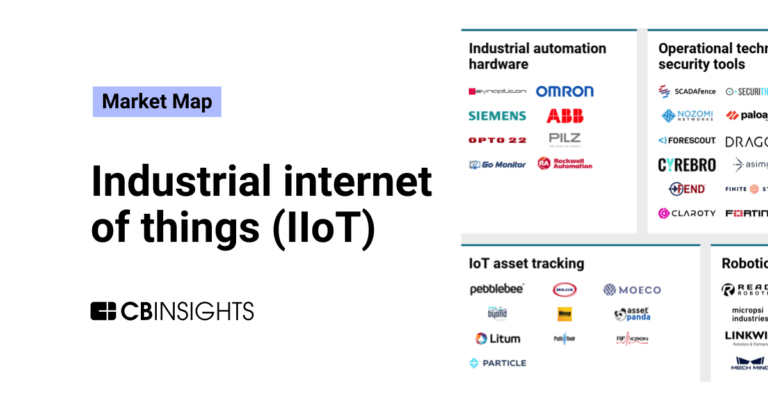

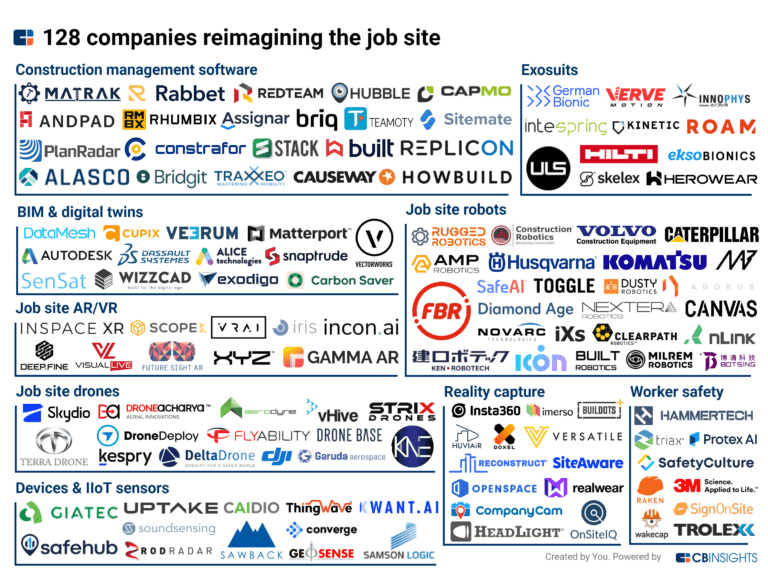

The industrial internet of things (IIoT) market map

Nov 18, 2022

128 companies building the future of the job siteExpert Collections containing Uptake

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uptake is included in 9 Expert Collections, including Construction Tech.

Construction Tech

1,467 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Supply Chain & Logistics Tech

4,391 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

Oil & Gas Tech

4,980 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Tech IPO Pipeline

286 items

Energy Management Software

677 items

Companies creating software to help manage, optimize, and automate energy management and optimization.

Uptake Patents

Uptake has filed 90 patents.

The 3 most popular patent topics include:

- lung disorders

- respiratory therapy

- climate modeling

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/24/2022 | 12/24/2024 | Machine learning, Covariance and correlation, Dimension reduction, Classification algorithms, Linear algebra | Grant |

Application Date | 1/24/2022 |

|---|---|

Grant Date | 12/24/2024 |

Title | |

Related Topics | Machine learning, Covariance and correlation, Dimension reduction, Classification algorithms, Linear algebra |

Status | Grant |

Latest Uptake News

Apr 4, 2025

Posted on IBM (US), AWS (US), Google (US), Microsoft (US), SAS Institute (US), TIBCO Software (US), Altair (US), Oracle (US), Splunk (US), C3.ai (US), Emerson (US), GE (US), Honeywell (US), PTC (US), Uptake (US), UpKeep (US), Limble (US), SenseGrow (US). Predictive Maintenance Market Size, by Technology (Analytics, Data Management, AI, IoT Platform, Sensors), Technique (Vibration Analysis, Infrared Thermography, Oil analysis, Motor Circuit Analysis, Acoustic Monitoring) – Forecast to 2029. A research report titled “ US Predictive Maintenance Market Size, by Technology (Analytics, Data Management, AI, IoT Platform, Sensors), Technique (Vibration Analysis, Infrared Thermography, Oil Analysis, Motor Circuit Analysis, Acoustic Monitoring) – Global Forecast to 2029″, published by MarketsandMarkets, projects that the US predictive maintenance market will grow from USD 3.6 billion in 2024 to USD 15.2 billion by 2029, registering a compound annual growth rate (CAGR) of 32.8% during the forecast period. The US predictive maintenance market is driven by the increasing adoption of IoT, AI, and machine learning in industrial operations, reducing downtime and maintenance costs. Regulatory compliance and asset optimization further fuel demand. However, challenges include high implementation costs, data security concerns, and the need for skilled professionals to manage advanced predictive analytics systems. The solution segment accounted for the largest share by component segment in the US predictive maintenance market in 2024. The solutions segment of the predictive maintenance market in the U.S. is projected to capture the largest share, thanks to the growing use of advanced analytics, AI-powered diagnostics, and IoT-enabled monitoring systems across various industries. Companies are increasingly turning to predictive maintenance solutions to minimize unexpected downtime, boost asset performance, and prolong the lifespan of their equipment. There’s a noticeable rise in demand for both cloud-based and on-premise predictive maintenance software, especially in sectors like manufacturing, energy, and transportation, where real-time data insights significantly improve operational efficiency. Moreover, the surge in investments in Industry 4.0 technologies is further solidifying the lead of solutions over services in the US. The vibration analysis segment accounted for the largest share by technique segment in the US predictive maintenance market in 2024. Vibration analysis is projected to dominate the largest market share in the US predictive maintenance market because of its efficiency in identifying early indicators of mechanical failures in essential rotating machinery like motors, turbines, and compressors. Industries such as manufacturing, energy, and aerospace heavily depend on vibration monitoring to spot issues like imbalances, misalignments, and bearing faults before they escalate into expensive breakdowns. Its non-invasive nature, remarkable accuracy, and ability to provide real-time diagnostics make it a favored option for asset maintenance. Additionally, the growth of IoT and wireless sensors has made vibration analysis more accessible and widely adopted across different sectors. The artificial intelligence (AI) segment is expected to grow at the highest rate during the forecast period. Artificial intelligence (AI) technology is set to grow fastest in the US predictive maintenance market due to its knack for boosting data-driven decision-making, automating the detection of anomalies, and making highly accurate failure predictions. By harnessing machine learning algorithms, deep learning, and neural networks, AI-powered predictive maintenance dives into massive datasets collected from IoT sensors, providing real-time insights and proactive maintenance strategies. As more industries turn to AI solutions to cut operational costs, reduce downtime, and enhance asset performance, the demand for AI-based predictive maintenance is skyrocketing, especially in sectors like manufacturing, energy, and transportation, fueling its rapid expansion. Top Companies in the US Predictive Maintenance Market Key players in the US predictive maintenance market are IBM (US), AWS (US), Google (US), Microsoft (US), SAS Institute (US), TIBCO Software (US), Altair (US), Oracle (US), Splunk (US), C3.ai (US), Emerson (US), GE (US), Honeywell (US), PTC (US), Uptake (US), UpKeep (US), Limble (US), SenseGrow (US). Media Contact

Uptake Frequently Asked Questions (FAQ)

When was Uptake founded?

Uptake was founded in 2014.

Where is Uptake's headquarters?

Uptake's headquarters is located at 2045 West Grand Avenue, Chicago.

What is Uptake's latest funding round?

Uptake's latest funding round is Incubator/Accelerator - II.

How much did Uptake raise?

Uptake raised a total of $317M.

Who are the investors of Uptake?

Investors of Uptake include Plug and Play, GreatPoint Ventures, Revolution, Plug and Play Milan, Valor Equity Partners and 6 more.

Who are Uptake's competitors?

Competitors of Uptake include AspenTech, Augury, Preteckt, Amygda, Avathon and 7 more.

What products does Uptake offer?

Uptake's products include Uptake Fusion and 4 more.

Who are Uptake's customers?

Customers of Uptake include PepsiCo, Ensign Drilling and APS/Palo Verde Nuclear Generating Station.

Loading...

Compare Uptake to Competitors

Falkonry specializes in time series artificial intelligence (AI) for smart manufacturing, focusing on operational efficiency and decision-making in sectors such as metals, defense and intelligence, chemicals, electronics and semiconductors, oil and gas, automotive, and pharmaceuticals. The company provides solutions that analyze operational time series data to enable condition-based actions, predictive maintenance, quality assessment, and process optimization. It was founded in 2012 and is based in Cupertino, California.

Cognite offers an industrial software-as-a-service (SaaS) that specializes in digitalizing the industrial world. The company's main offering is Cognite Data Fusion (CDF), a software product that contextualizes operational technology (OT) and information technology (IT) data to develop scalable solutions for asset-intensive industries. Cognite primarily serves sectors such as oil and gas, power and utilities, renewable energy, and manufacturing, providing technologies that facilitate sustainable and efficient operations. It was founded in 2016 and is based in Lysaker, Norway.

Avathon specializes in artificial intelligence (AI) solutions across various sectors, including energy, manufacturing, government, education, and retail. The company offers products and services that enable predictive maintenance, fraud detection, and cybersecurity, with a focus on preventing zero-day attacks. Avathon's AI technology is designed to analyze and optimize data, augment human intelligence, and enhance operational efficiency. It was formerly known as SparkCognition. It was founded in 2013 and is based in Pleasanton, California.

DINGO is a global leader in Predictive Maintenance, providing software solutions for the Mining and Defence industries. The company offers enterprise-level software that predicts and prevents equipment failures, optimizes asset health, and aims to reduce maintenance costs while increasing production safety and efficiency. DINGO's software is used to manage the health of over $13.5 billion worth of heavy equipment, helping to save maintenance and replacement costs. It was founded in 1991 and is based in Wilston, Queensland.

Imubit specializes in AI process optimization for the hydrocarbon processing industry. The company offers a Closed Loop Neural Network Platform that leverages deep learning process control to enhance profitability, energy efficiency, and sustainability in refineries and chemical plants. It was founded in 2016 and is based in Houston, Texas.

Intelecy is an industrial AI company that focuses on optimizing processes across various sectors. The platform allows process engineers and operators to deploy machine learning models and monitor production in real-time. Intelecy serves the manufacturing and process sectors, including food and beverage, mining, metals and minerals, water and wastewater, power and renewable energy, and chemicals. It was founded in 2016 and is based in Oslo, Norway.

Loading...