Varo

Founded Year

2015Stage

Series G | AliveTotal Raised

$1.07BLast Raised

$28.98M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+56 points in the past 30 days

About Varo

Varo is a digital bank that provides financial services. The company offers savings accounts, credit-building tools, and borrowing options like cash advances and personal lines of credit. Varo primarily serves individuals seeking banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Loading...

Varo's Products & Differentiators

Varo checking

standard checking acct

Loading...

Research containing Varo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Varo in 2 CB Insights research briefs, most recently on Apr 10, 2025.

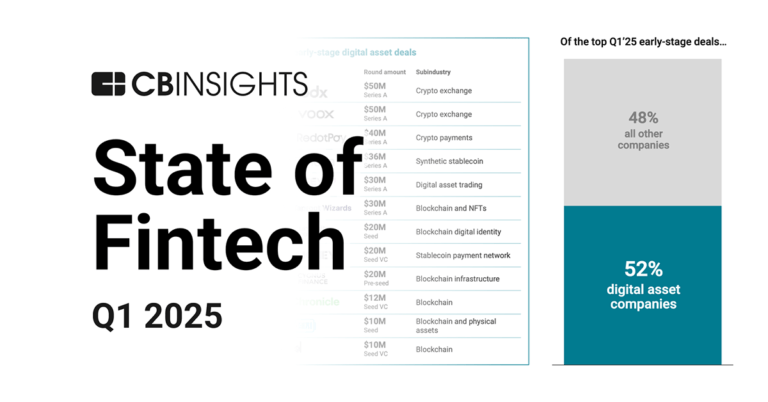

Apr 10, 2025 report

State of Fintech Q1’25 ReportExpert Collections containing Varo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Varo is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Financial Wellness

245 items

Track startups and capture company information and workflow.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,112 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Varo Patents

Varo has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/12/2018 | 11/28/2023 | Boilers, Papermaking, Cleaning tools, Sanitation, Chemical processes | Grant |

Application Date | 9/12/2018 |

|---|---|

Grant Date | 11/28/2023 |

Title | |

Related Topics | Boilers, Papermaking, Cleaning tools, Sanitation, Chemical processes |

Status | Grant |

Latest Varo News

Mar 19, 2025

The London-based digital bank will buy Community Unity Bank to get a U.S.-based charter and gain a toehold among lower mid-market business. Published March 19, 2025 Dive Brief: London-based digital bank OakNorth intends to buy Birmingham, Michigan-based Community Unity Bank, the U.K. company announced Monday . The deal, which is awaiting regulatory approval, will enable OakNorth to expand its business lending services across Michigan and the U.S., the company said. The acquisition follows OakNorth’s authorization from the Federal Reserve and New York’s Department of Financial Services last August to open a representative office in New York City. Dive Insight: “Demand from US borrowers continues to be exceptionally strong and our differentiated offering and unique approach to lending has enabled us to rapidly establish a strong presence in the US market, resulting in us lending [three times] our initial expectations,” OakNorth CEO Rishi Khosla said in a statement. “As a founder-led business built by entrepreneurs, [Community Unity Bank] appealed to us as it shares a lot of our same values with regards to customer experience.” OakNorth began offering its services in the U.S. in July 2023 and has since lent more than $700 million to businesses in the country, including many of its existing customers with U.S. and U.K. operations. “In the summer of 2023 following the collapse of several US banks which had been focused on serving the lower mid-market, we saw an opportunity to step up and do our part in helping to fill the funding gap they were experiencing,” Khosla said in the press release. OakNorth plans to close the deal as soon as it gets the regulatory green light, though regulatory approval can take up to a year or more, an OakNorth spokesperson said. The digital lender intends to retain all of the community bank employees and keep the one Community Unity Bank branch open, the spokesperson said. Founded in 2015, the digital bank focuses on serving lower mid-market businesses with $1 million to $100 million in turnover, providing roughly $16 billion in loans, it said. Since OakNorth began lending in the U.S., its focus has been on the Tri-State area around New York City, the spokesperson said, adding that the company plans to “continue growing organically vs via [mergers and acquisitions]” but is “open to exploring additional M&A opportunities” that align with OakNorth’s mission and strategic objectives. Community Unity Bank’s team will help OakNorth to expand across the U.S., and its CEO Greg Wernette, will serve as the CEO of OakNorth’s U.S. bank. “With an entrepreneurial focus at our core, and every team member striving for customer delight, we are very excited to be joining forces with OakNorth to support an even greater number of US businesses together,” Wernette said in a statement Monday. The community bank offers businesses and individuals a suite of banking products, primarily in Southeast Michigan. “When I founded the bank in 2023, we were confident that with the right approach, the right people and the right customers, we would realize success,” founder Andy Meisner said in a LinkedIn post Monday. “I did not anticipate, however, the degree to which we would move this bank forward in such a short period of time. We have built a tremendous foundation.” President Donald Trump’s return to the White House has reignited the debate about whether we would see an uptick in mergers and acquisitions . In a January interview, Robert Tammero, a partner at K&L Gates said he thinks smaller banks need to consider partnering or acquiring fintechs to remain strong and viable in the financial field since fintechs can benefit from stable, low-cost funding from banks. Brian Graham, a partner at advisory and investment firm Klaros Group, said he expects an unpick in such deals – involving both international and U.S.-based fintechs and new charter applications. “OakNorth is pursuing a US banking license for the simple reason that the US is a large and attractive market and the new administration, unlike the previous regime, appears to be open to approving such transactions, just like it is open to reviewing and approving applications for new bank charters,” Graham said in an email. SmartBiz , a small-business lender, announced Monday that it acquired Illinois-based Centrust Bank and received the regulatory approval to become a bank and a bank holding company. One Main Financial last week applied for an industrial loan company charter with Utah’s Department of Financial Institutions and the Federal Deposit Insurance Corp. Varo in July 2020 became the first challenger bank to secure a national charter. “There are no laws or regulations that prevent such transactions,” Graham said. “The lack of receptivity under the [Biden] administration was an exercise, I suppose, of regulatory discretion.” Graham’s Klaros colleague, Michele Alt, worked with SmartBiz and Centrust on their regulatory applications.

Varo Frequently Asked Questions (FAQ)

When was Varo founded?

Varo was founded in 2015.

Where is Varo's headquarters?

Varo's headquarters is located at 222 Kearny Street, San Francisco.

What is Varo's latest funding round?

Varo's latest funding round is Series G.

How much did Varo raise?

Varo raised a total of $1.07B.

Who are the investors of Varo?

Investors of Varo include 8VC, Warburg Pincus, The Rise Fund, HarbourVest Partners, Gallatin Point Capital and 13 more.

Who are Varo's competitors?

Competitors of Varo include Revolut, MoneyLion, Monzo, Atom Bank, Ant Group and 7 more.

What products does Varo offer?

Varo's products include Varo checking and 1 more.

Loading...

Compare Varo to Competitors

Chime provides banking services. The company offers a banking application that includes features such as direct deposit, no overdraft fees, and resources for financial literacy. Chime was formerly known as 1debit. It was founded in 2012 and is based in San Francisco, California.

ONE serves as a financial technology company that provides banking services through a digital platform. The company offers services including debit rewards, credit score monitoring, credit building loans, and savings accounts. ONE serves individuals looking to manage finances. ONE was formerly known as Even. It was founded in 2022 and is based in New York, New York.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Tandem Bank provides digital banking services in the financial sector. The company offers financial products including savings accounts, green home improvement loans, energy-efficient mortgages, and motor finance for eco-friendly vehicles. Tandem Bank serves individuals making environmentally conscious financial decisions. It was founded in 2013 and is based in Blackpool, England.

Loading...