Vise

Founded Year

2016Stage

Series C | AliveTotal Raised

$126.55MValuation

$0000Last Raised

$65M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-49 points in the past 30 days

About Vise

Vise is an asset manager that creates and manages investment portfolios for financial advisors. The company provides portfolio management solutions that include tax-loss harvesting, investment strategies, and insights to inform investment decisions. Vise serves independent Registered Investment Advisors (RIAs) and RIA aggregators, providing them with tools for their practices. It was founded in 2016 and is based in New York, New York.

Loading...

Vise's Product Videos

_thumbnail.png?w=3840)

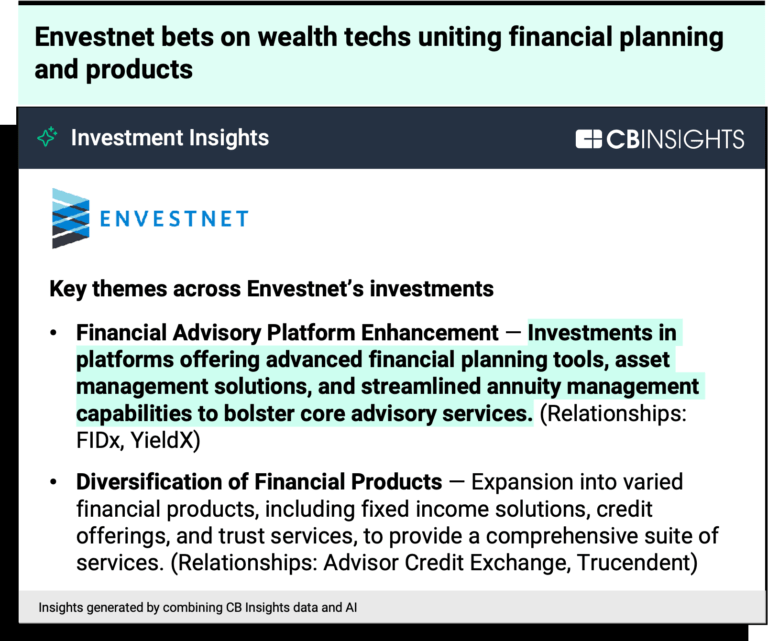

ESPs containing Vise

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The investment portfolio construction & optimization market uses data-driven algorithms and analytics to help financial professionals optimize portfolio composition, risk management, and returns. Solutions in this market take into account various factors such as asset allocation, risk tolerance, market trends, and investment goals to craft tailored portfolios for clients. These solutions facilitat…

Vise named as Challenger among 12 other companies, including Betterment, Qraft Technologies, and YieldX.

Vise's Products & Differentiators

Vise Portfolio Construction Engine

Sleek interface that allows advisors to build personalized portfolios containing single securities and/or ETFs for every client.

Loading...

Research containing Vise

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Vise in 2 CB Insights research briefs, most recently on Sep 27, 2024.

Oct 6, 2023

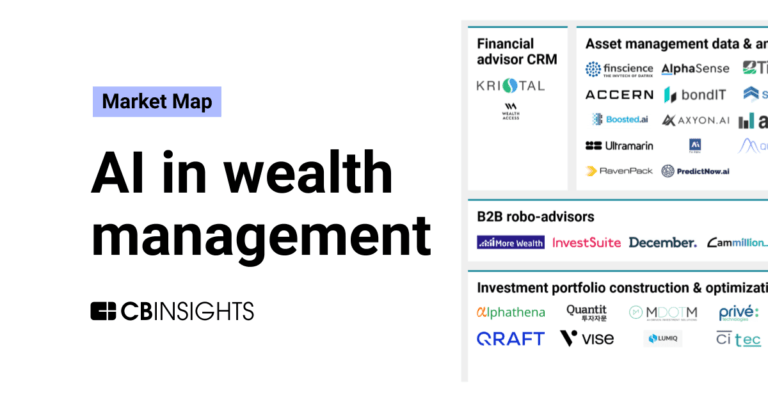

The AI in wealth management market mapExpert Collections containing Vise

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Vise is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Artificial Intelligence

7,221 items

Latest Vise News

Mar 15, 2025

Integer Holdings Co. (NYSE:ITGR) Receives $147.67 Average PT from Analysts Posted by MarketBeat News on Mar 15th, 2025 Shares of Integer Holdings Co. ( NYSE:ITGR – Get Free Report ) have been assigned an average recommendation of “Moderate Buy” from the eight analysts that are currently covering the stock, MarketBeat reports. Two analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. The average 12 month price objective among brokers that have issued a report on the stock in the last year is $149.00. Several research analysts recently issued reports on ITGR shares. Oppenheimer lowered shares of Integer from an “outperform” rating to a “market perform” rating in a research report on Friday, February 21st. Truist Financial increased their target price on Integer from $147.00 to $163.00 and gave the stock a “buy” rating in a report on Wednesday, December 11th. Benchmark boosted their price target on Integer from $140.00 to $150.00 and gave the company a “buy” rating in a research note on Friday, February 21st. KeyCorp increased their price objective on Integer from $144.00 to $154.00 and gave the stock an “overweight” rating in a research note on Friday, January 24th. Finally, Citigroup boosted their target price on shares of Integer from $130.00 to $145.00 and gave the company a “neutral” rating in a research note on Wednesday, December 11th. Get Integer alerts: Shares of NYSE:ITGR opened at $117.76 on Wednesday. The business’s 50 day moving average is $134.11 and its 200-day moving average is $132.68. The company has a current ratio of 2.95, a quick ratio of 2.09 and a debt-to-equity ratio of 0.62. The firm has a market capitalization of $3.96 billion, a PE ratio of 35.05, a PEG ratio of 1.72 and a beta of 1.24. Integer has a 1-year low of $107.11 and a 1-year high of $146.36. Integer ( NYSE:ITGR – Get Free Report ) last announced its quarterly earnings results on Thursday, February 20th. The medical equipment provider reported $1.43 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.46 by ($0.03). The business had revenue of $449.50 million during the quarter, compared to the consensus estimate of $446.28 million. Integer had a net margin of 6.92% and a return on equity of 11.65%. Sell-side analysts predict that Integer will post 6.01 earnings per share for the current year. Hedge Funds Weigh In On Integer A number of institutional investors and hedge funds have recently bought and sold shares of ITGR. Universal Beteiligungs und Servicegesellschaft mbH bought a new position in shares of Integer in the fourth quarter valued at about $7,889,000. Brucke Financial Inc. acquired a new stake in Integer in the 4th quarter valued at about $564,000. Azzad Asset Management Inc. ADV raised its stake in shares of Integer by 4.9% in the fourth quarter. Azzad Asset Management Inc. ADV now owns 12,138 shares of the medical equipment provider’s stock worth $1,609,000 after acquiring an additional 566 shares during the last quarter. Vise Technologies Inc. lifted its position in shares of Integer by 8.3% during the fourth quarter. Vise Technologies Inc. now owns 4,702 shares of the medical equipment provider’s stock worth $623,000 after purchasing an additional 362 shares in the last quarter. Finally, Squarepoint Ops LLC grew its stake in shares of Integer by 25.7% during the fourth quarter. Squarepoint Ops LLC now owns 3,162 shares of the medical equipment provider’s stock valued at $419,000 after purchasing an additional 646 shares during the last quarter. Institutional investors and hedge funds own 99.29% of the company’s stock. About Integer

Vise Frequently Asked Questions (FAQ)

When was Vise founded?

Vise was founded in 2016.

Where is Vise's headquarters?

Vise's headquarters is located at 521 Broadway, New York.

What is Vise's latest funding round?

Vise's latest funding round is Series C.

How much did Vise raise?

Vise raised a total of $126.55M.

Who are the investors of Vise?

Investors of Vise include Sequoia Capital, Ribbit Capital, Greenoaks, Sand Hill Capital, Michael Ovitz and 20 more.

Who are Vise's competitors?

Competitors of Vise include Fundment, Aisot Technologies, Pebble, O'Shaughnessy Asset Management, Betterment and 7 more.

What products does Vise offer?

Vise's products include Vise Portfolio Construction Engine and 1 more.

Who are Vise's customers?

Customers of Vise include Greenstone Wealth Management and CPR Financial.

Loading...

Compare Vise to Competitors

Wealthfront is a financial services company that focuses on automated investing and wealth building for individuals. The company offers a range of services, including savings accounts, investment in US Treasury bonds, and diversified portfolio management using automated technology. Wealthfront's products are designed to cater to both seasoned and novice investors, aiming to simplify the investment process and maximize returns over the long term. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Ellevest is a financial services company that focuses on wealth accumulation and financial guidance with a specialization in serving women. The company offers online investing services, financial planning, and private wealth management tailored to address gender-specific financial challenges and goals. Ellevest primarily caters to individuals seeking personalized investment strategies and financial planning, with a particular emphasis on the unique financial needs of women. Ellevest was formerly known as Ellevate Financial, Inc.. It was founded in 2014 and is based in New York, New York.

Guideline provides retirement savings solutions within the financial services sector. The company offers customizable 401(k) plans for businesses, simplified employee pensioniIndividual retirement arrangement (SEP IRAs) for self-employed individuals, as well as traditional and Roth IRAs for personal retirement savings. Guideline serves the financial technology and retirement services industry, catering to businesses and individual savers. It was founded in 2015 and is based in Burlingame, California.

Magnus is a company operating in the financial technology sector that provides investment management services. It offers a platform that includes portfolio optimization, construction, rebalancing, and reporting, designed for individual and institutional investors. Magnus serves individual investors, portfolio advisors, and banks with quantitative tools. Magnus was formerly known as Akıllıfon. It was founded in 2018 and is based in Izmir, Turkey.

Physis Investment serves as an impact investing platform that operates within the financial technology sector. The company offers a datahub platform that provides insights, allowing investors to track the performance of their portfolios with a focus on metrics. Physis Investment caters primarily to financial institutions and advisors, allowing them to make investment decisions based on data analysis and metrics. It was founded in 2019 and is based in Allston, Massachusetts.

d1g1t provides an enterprise wealth management platform in the financial technology sector. The company offers a comprehensive suite of analytics and risk management tools designed to enhance the quality of financial advice and streamline wealth management operations. Its services cater to financial advisory firms, multi-family offices, registered investment advisors (RIAs), broker-dealers, and bank advisor networks, aiming to integrate various aspects of wealth management into a cohesive system. It was founded in 2017 and is based in Toronto, Canada.

Loading...