Zepz

Founded Year

2010Stage

Line of Credit - II | AliveTotal Raised

$1.124BLast Raised

$110M | 13 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+40 points in the past 30 days

About Zepz

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, United Kingdom.

Loading...

ESPs containing Zepz

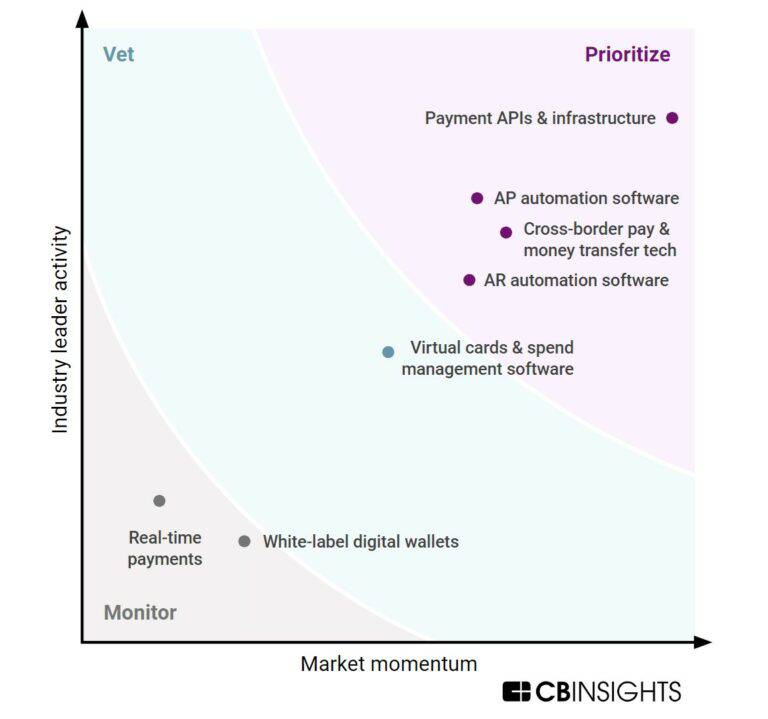

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The P2P (peer-to-peer) cross-border payments platforms market facilitates the direct transfer of funds between consumers located in different countries. Some providers specialize in remittances more broadly, while others target money movement between specific countries. Most offer accounts where users can hold their money as well.

Zepz named as Highflier among 15 other companies, including PayPal, Wise, and Remitly.

Loading...

Research containing Zepz

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zepz in 2 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Zepz

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zepz is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Latest Zepz News

Apr 1, 2025

Last updated: 01/04/25 SHARE Zepz , the parent company of WorldRemit and Sendwave, has secured $165 million in new financing to strengthen its financial position and fuel growth. The deal includes a $110 million revolving credit facility led by HSBC Innovation Banking and a $55 million term facility underwritten by HSBC Private Credit. Why it matters This financing replaces a previous $80 million arrangement, reinforcing a decade-long partnership between Zepz and HSBC. It enhances Zepz’s ability to invest in faster transactions, optimize transfer fees, and expand its global footprint in digital remittances. By the numbers The platforms process more than 8 million transactions monthly. Last year, Zepz raised $267 million in a Series F funding round despite a challenging fintech investment landscape. What they’re saying Mark Lenhard, CEO at Zepz: “This expanded facility strengthens our ability to invest in better pricing and ongoing innovation, empowering migrants with the tools they need to build secure futures and overcome financial barriers.” Barrie Morris, CFO at Zepz: “By lowering borrowing costs, this facility improves our financial flexibility and ensures we can continue delivering high-quality, cost-effective services.” Angela Mylrea, Head of Corporate Credit Solutions at HSBC Innovation Banking UK: “We are delighted to deepen our partnership with Zepz. This facility underscores our commitment to supporting high-growth fintech companies.”

Zepz Frequently Asked Questions (FAQ)

When was Zepz founded?

Zepz was founded in 2010.

Where is Zepz's headquarters?

Zepz's headquarters is located at 62 Buckingham Gate, London.

What is Zepz's latest funding round?

Zepz's latest funding round is Line of Credit - II.

How much did Zepz raise?

Zepz raised a total of $1.124B.

Who are the investors of Zepz?

Investors of Zepz include HSBC Global Private Banking, HSBC Innovation Banking, Accel, Technology Crossover Ventures, LeapFrog Investments and 10 more.

Who are Zepz's competitors?

Competitors of Zepz include TerraPay, Capi, MobiKwik, Ripple, AZA Finance and 7 more.

Loading...

Compare Zepz to Competitors

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the business-to-business (B2B) sector. The company offers an online payment platform that facilitates multi-currency transactions, Treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg City, Luxembourg.

Airwallex develops a global financial platform that focuses on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Coins.ph is a cryptocurrency exchange and digital wallet provider in the financial technology sector. The company offers a platform for buying, selling, and storing various cryptocurrencies, as well as services for utility bill payments and mobile load purchases. Coins.ph primarily serves individual users and businesses looking to engage with digital assets and cryptocurrency trading. It was founded in 2014 and is based in Pasig City, Philippines. Coins.ph operates as a subsidiary of Wei Zhou.

MoMo is a financial technology company that specializes in digital payment solutions and super application development. The company offers a comprehensive ecosystem that allows users to perform various daily activities through their platform, as well as leveraging data analytics and AI to enhance user experience and merchant services. MoMo's products cater to various sectors, including financial services, e-commerce, and more. It was founded in 2007 and is based in Ho Chi Minh City, Vietnam.

Toss operates as a digital financial platform. It offers a range of financial services, including bank accounts, money transfers, a financial dashboard, credit score management, customized loans, insurance plans, and multiple investment services. It was founded in 2013 and is based in Seoul, South Korea.

BitGo provides digital asset custody and financial services within the cryptocurrency sector. The company offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. BitGo serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Loading...