Zetwerk

Founded Year

2018Stage

Series F - V | AliveTotal Raised

$1.012BValuation

$0000Last Raised

$4.94M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-96 points in the past 30 days

About Zetwerk

Zetwerk offers a manufacturing network that provides manufacturing services across sectors. It offers custom-made components, mass production, quality certification, inventory, and supply chain management, focusing on precision parts, capital goods, and consumer goods. It operates in industries such as transportation, industrial machinery, consumer products, construction, energy, and aerospace. It was founded in 2018 and is based in Bengaluru, India.

Loading...

Zetwerk's Product Videos

ESPs containing Zetwerk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand manufacturing platforms market facilitates the on-demand production of goods by connecting businesses seeking manufacturing services with a network of manufacturing partners capable of producing custom or small-batch orders. These platforms have emerged as a solution for businesses seeking flexibility, reduced lead times, and cost-effective manufacturing options, particularly for pro…

Zetwerk named as Leader among 15 other companies, including Dassault Systemes, Xometry, and Stratasys.

Zetwerk's Products & Differentiators

General Fabrication

Non-precision manufacturing such as steel structurals, bridges, etc.

Loading...

Research containing Zetwerk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zetwerk in 2 CB Insights research briefs, most recently on Mar 1, 2024.

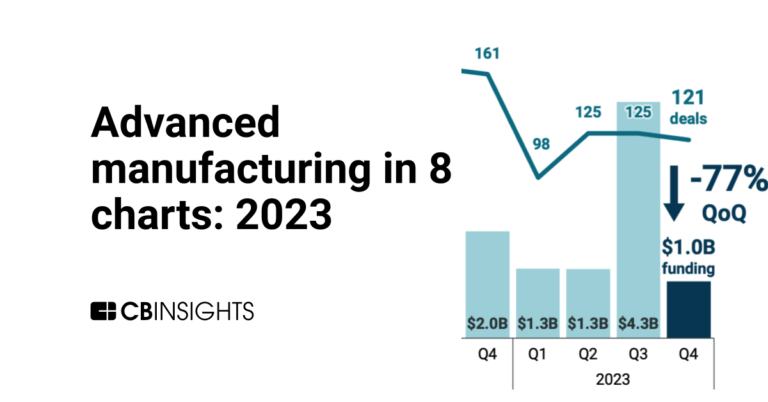

Mar 1, 2024

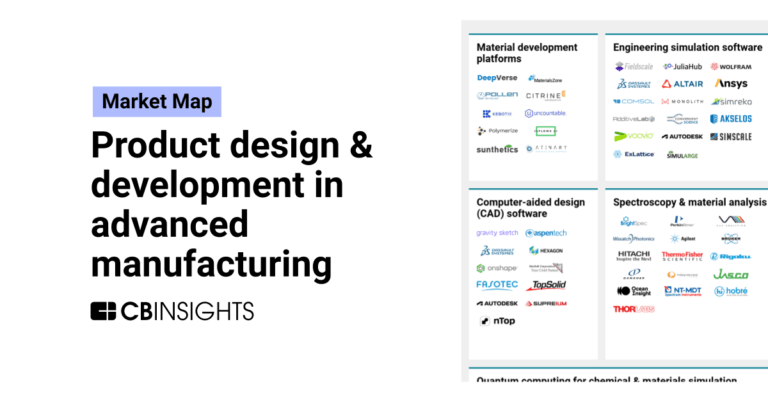

Advanced manufacturing in 8 charts: 2023Expert Collections containing Zetwerk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zetwerk is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,245 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Supply Chain & Logistics Tech

4,391 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

Advanced Manufacturing

7,125 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Advanced Manufacturing 50

50 items

Latest Zetwerk News

Mar 29, 2025

Cabinet greenlights Rs 23,000 crore e-parts production scheme SECTIONS ETtech Rate Story Synopsis India's Rs 23,000-crore electronics component manufacturing (ECM) scheme aims to boost domestic production, create jobs, and integrate with global value chains. Over the next six years, it will focus on passive components, sub-assemblies, and capital goods. The scheme offers targeted incentives based on jobs, turnover, and capital expenditure to stimulate growth. Agencies The Cabinet has approved a Rs 23,000-crore programme to strengthen the electronics manufacturing supply chain. India is looking to grab a bigger share of the market as companies opt for ‘China Plus One,’ as well as create jobs. The much-anticipated electronics component manufacturing (ECM) scheme is a move to increase domestic value addition and integrate with global value chains. It will be spread over six years and is expected to generate investment worth Rs 60,000 crore. “We are already making very good progress in the semiconductor part of the value chain,” said Ashwini Vaishnaw , minister for electronics and IT, railways and information and broadcasting, referring to the production-linked incentive (PLI) scheme. “We have had super success in PLI-based finished products manufacturing. Now, we are covering sub-assemblies and bare components.” Employment, turnover, capex criteria The ECM scheme is expected to result in Rs 4.57 lakh crore of production and generate 91,600 direct jobs, apart from indirect employment opportunities. Live Events It provides differentiated incentives tailored to overcome specific disabilities for various categories of components and sub-assemblies so they can acquire technological capabilities and achieve economies of scale. Discover the stories of your interest It has a one-year gestation period and the incentives are split across three different sets of criteria. For some companies, the target will be related to jobs and for others, it will be linked to turnover. It will be linked to capital expenditure incurred for those that require heavy investment. The details are expected over the next few weeks, Vaishnaw said. The scheme will focus on passive component and sub-assembly manufacturing in India, especially capital goods or machinery — a critical need for self-reliance in manufacturing, said Vaishnaw. It will also complement active component manufacturing under the Rs 76,000 crore India Semiconductor Mission (ISM). Sectoral reaction The industry welcomed the programme and said it will not only help with value addition but also lower costs. “When it comes to the main objective of deepening the value addition, this is a significant initiative,” said Atul Lall, chief executive and managing director of Dixon Technologies , among the biggest homegrown contract makers. “Components comprise 45-50% of the bill of material, so from Dixon's perspective, we were keenly awaiting this.” By supporting the development of essential chip components, compound semiconductors and advanced packaging technologies, the policy will help establish a more resilient and globally competitive supply chain, said Hitesh Garg, India managing director of NXP Semiconductors. “For the industry, this move signals a strong commitment to positioning India as a key player in the global ESDM (electronics system design and manufacturing) landscape,” he said. “It will accelerate innovation across automotive, industrial and (Internet of Things) IoT applications, ensuring India is a significant contributor to next-generation technology.” Josh Foulger, president of electronics at contract maker Zetwerk, called it an “incredible” step towards truly strengthening the ESDM ecosystem. “It will get India on a track to be very competitive to serve global value chains,” he said. “I think it will be very successful because when you're trying to serve the India and the India-plus journey, you have to have a local supply for enabling quicker time to market and quicker time for production — just in time, for instance. Both these things get accelerated and then companies can do global deliveries effectively out of India without carrying huge inventories, or getting delayed product ramp-ups, and so on.” He said this move gives India the opportunity to be competitive on the total cost of goods. “It’s wonderful to see the government incentivise and take care of any short-term and mid-term cost disabilities we may have,” Foulger said. “This will definitely enable value addition improvement. In the next 24-30 months, we will start to see an uptick.” Three heads Vaishnaw cited the example of a printed circuit board (PCB) to explain the benefits of a scheme that takes into account the complex and interconnected nature of key electronic components. A PCB has multiple layers, with many devices running on it— a CPU, capacitors, inductors, resistors, a battery pack, heat sink and multiple other connectors. “The manufacturing of all these (components) will now happen in the country. This will significantly improve value addition that we get,” Vaishnaw said. Under the scheme, display and camera module sub-assembly will receive a turnover-linked incentive. Similarly, bare components like non-surface mount devices (non-SMD) passive components for electronic applications, electro-mechanicals, multi-layer PCB, Li-ion cells for digital applications (excluding storage and mobility), enclosures for mobile, IT hardware products and related devices will also get turnover linked incentives. Selected bare components like high-density interconnect, modified semi-additive process, flexible PCB as well as SMD passive components will get hybrid incentives. Parts used in manufacturing of sub-assembly and bare components, as well as capital goods used in electronics manufacturing — including their sub-assemblies and components — will be eligible for capex incentives. Read More News on

Zetwerk Frequently Asked Questions (FAQ)

When was Zetwerk founded?

Zetwerk was founded in 2018.

Where is Zetwerk's headquarters?

Zetwerk's headquarters is located at 17th Cross, HSR Layout, Bengaluru.

What is Zetwerk's latest funding round?

Zetwerk's latest funding round is Series F - V.

How much did Zetwerk raise?

Zetwerk raised a total of $1.012B.

Who are the investors of Zetwerk?

Investors of Zetwerk include Oriental Biotech, ARC Investment Partners, Mehta Group, Baillie Gifford, Khosla Ventures and 31 more.

Who are Zetwerk's competitors?

Competitors of Zetwerk include CADDi, Infra.Market, OfBusiness, Credlix, Mymooo and 7 more.

What products does Zetwerk offer?

Zetwerk's products include General Fabrication and 4 more.

Loading...

Compare Zetwerk to Competitors

Moglix is a B2B e-commerce platform focused on the procurement of industrial supplies across various sectors. The company offers a wide range of products, including safety gear, power tools, office supplies, electrical equipment, and healthcare and lab supplies. Moglix caters primarily to the needs of the manufacturing, industrial, and business sectors by providing essential tools, equipment, and supplies necessary for their operations. It was founded in 2015 and is based in Singapore.

OfBusiness provides an online marketplace for business-to-business (B2B) commerce. The company sells products such as chemicals, steel, cement, agriculture, textiles, solar, and more. It was founded in 2015 and is based in Gurgaon, India.

IndustryBuying is a B2B e-commerce platform specializing in a wide array of industrial and agricultural products. The company offers a vast catalog of items across various categories such as tools, electrical components, and office supplies. IndustryBuying caters to the needs of businesses and SMEs, providing a seamless shopping experience with door-to-door delivery to every pin code in India, secure payment options, and a focus on reliability and safety. It was founded in 2013 and is based in New Delhi, India. IndustryBuying operates as a subsidiary of MonotaRO.

Eezee specializes in modern procurement and operates as a business supplies marketplace in the MRO (Maintenance, Repair, and Operations) sector. The company offers an online platform that connects businesses with a network of accredited suppliers for efficient sourcing and procurement of industrial and business supplies. Eezee's services cater to enterprises looking to streamline their supply chain management, offering features such as visual track and trace, ERP integration, and pre-negotiated pricing. It was founded in 2016 and is based in Singapore.

Udaan is a B2B e-commerce platform focused on the trade ecosystem for small businesses across various sectors. The company operates in categories such as FMCG, Staples, Fruits & Vegetables, and Pharma, providing a platform for supply chain and logistics operations. Udaan offers financial products and services through udaanCapital, addressing the working capital needs of small businesses, manufacturers, and retailers. It was founded in 2016 and is based in Bengaluru, India.

Infra.Market is a construction materials platform that integrates technology in the construction industry value chain. The company offers building materials including concrete, steel, ceramics, and electricals, and provides a platform for procurement, order placement, and logistics tracking for stakeholders in the construction sector. Infra.Market serves real estate developers, infrastructure projects, contractors, architects, dealers, and distributors. It was founded in 2016 and is based in Thane, India.

Loading...