Zilch

Founded Year

2018Stage

Line of Credit | AliveTotal Raised

$581.36MLast Raised

$64.8M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-12 points in the past 30 days

About Zilch

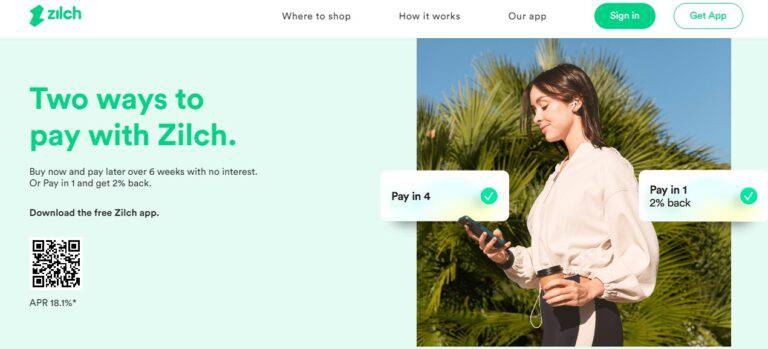

Zilch provides buy now pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the ecommerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Loading...

Zilch's Product Videos

ESPs containing Zilch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Zilch named as Outperformer among 15 other companies, including PayPal, Affirm, and Klarna.

Zilch's Products & Differentiators

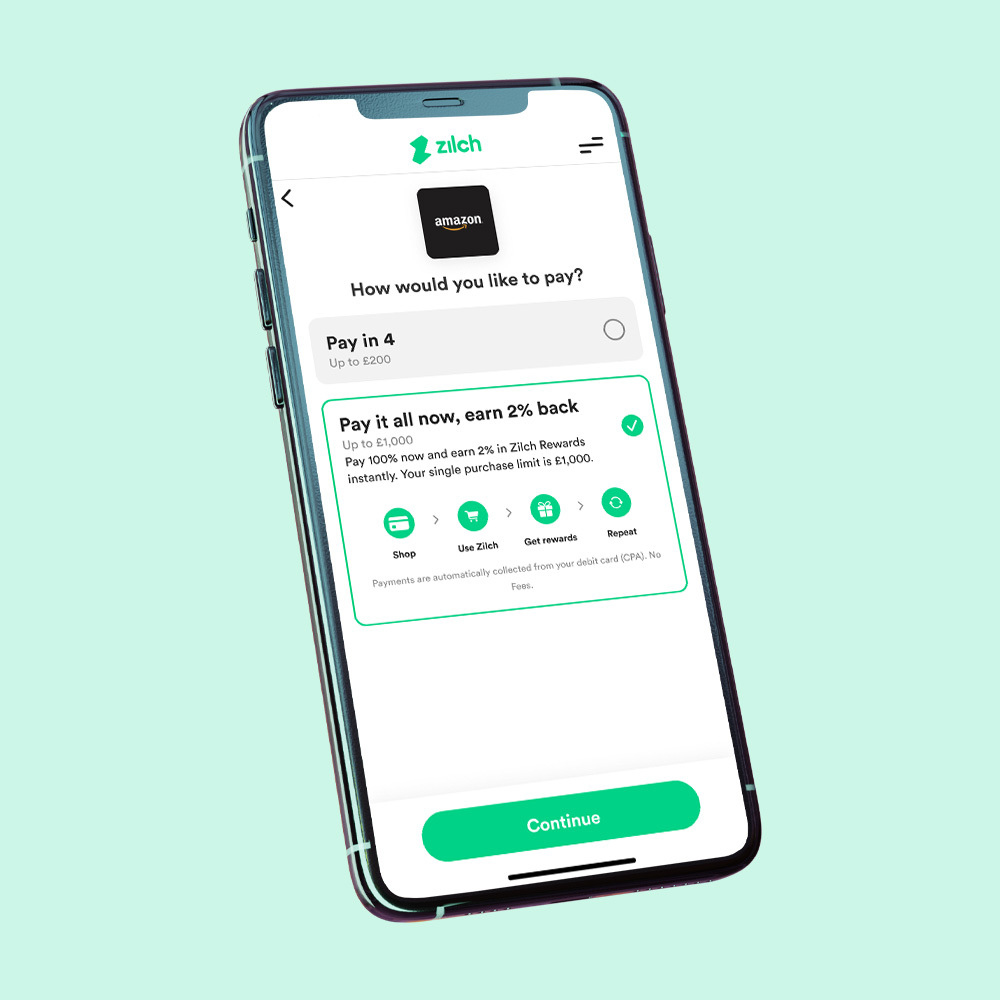

Pay in 1

Pay online or Tap & Pay anywhere in one and receive immediate cash back

Loading...

Research containing Zilch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

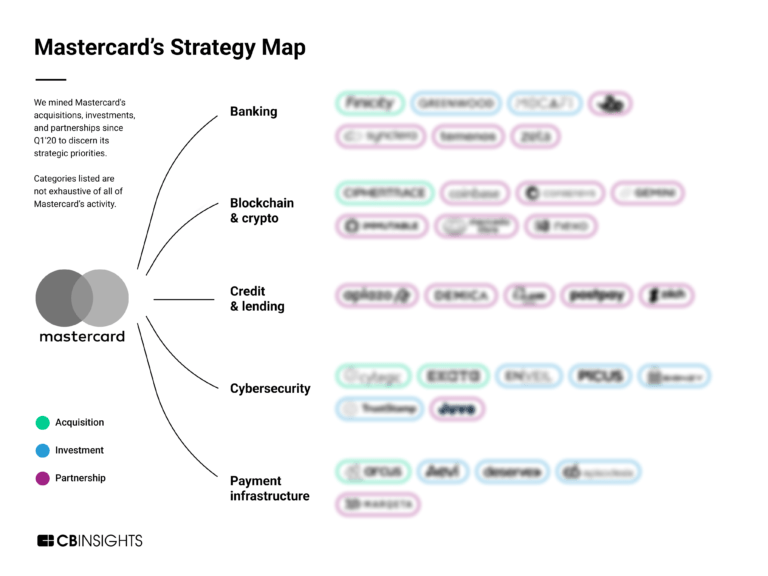

CB Insights Intelligence Analysts have mentioned Zilch in 2 CB Insights research briefs, most recently on Aug 22, 2022.

Expert Collections containing Zilch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zilch is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,462 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,577 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Zilch Patents

Zilch has filed 6 patents.

The 3 most popular patent topics include:

- credit cards

- merchant services

- online payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/28/2020 | 12/31/2024 | Payment systems, Payment service providers, Merchant services, Online payments, Credit cards | Grant |

Application Date | 10/28/2020 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Payment systems, Payment service providers, Merchant services, Online payments, Credit cards |

Status | Grant |

Latest Zilch News

Mar 27, 2025

LONDON--(BUSINESS WIRE)--Zilch, the fintech payments innovator of the world’s first ad-subsidised payments network (ASPN), has seen its undisputed position as the UK’s fastest-growing unicorn company confirmed in a Financial Times ranking of high-growth firms. The FT1000 league table ranked Zilch the highest of the UK’s unicorns - private firms worth more than $1 billion. With a compound annual revenue growth rate of more than 300% over the past three years, Zilch was recognised as both the sec

Zilch Frequently Asked Questions (FAQ)

When was Zilch founded?

Zilch was founded in 2018.

Where is Zilch's headquarters?

Zilch's headquarters is located at 111 Buckingham Palace Road, London.

What is Zilch's latest funding round?

Zilch's latest funding round is Line of Credit.

How much did Zilch raise?

Zilch raised a total of $581.36M.

Who are the investors of Zilch?

Investors of Zilch include Deutsche Bank, Leading European Tech Scaleups, eBay Ventures, Gauss Ventures, Ventura Capital and 7 more.

Who are Zilch's competitors?

Competitors of Zilch include BharatX, Tabby, Klarna, Hokodo, Mondu and 7 more.

What products does Zilch offer?

Zilch's products include Pay in 1 and 2 more.

Loading...

Compare Zilch to Competitors

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

SplitIt provides card-linked installment payment solutions within the financial technology sector. The company offers a platform that allows merchants to provide consumers with the ability to pay for purchases in installments using their existing credit cards, without the need for new loans or applications. SplitIt serves various industries, including automotive, consumer electronics, education, and healthcare, by providing services such as e-commerce installments, omnichannel payment solutions, and a 'pay after delivery' option. SplitIt was formerly known as PayItSimple. It was founded in 2012 and is based in Atlanta, Georgia.

Payl8r is a company that provides retail finance solutions in the financial services sector. It enables businesses to offer payment options that allow customers to finance purchases over time. Payl8r serves the ecommerce and retail sectors. It was founded in 2014 and is based in Manchester, England.

Billie specializes in BNPL payment methods for the B2B sector and offers digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Sunbit serves as a financial technology company and operates in the credit and lending industry. Its main service is providing a pay-over-time technology that allows customers to spread the cost of everyday needs such as auto repairs, dental care, eye care, and veterinary care. It primarily serves sectors such as the automotive industry, healthcare services, and retail. It was founded in 2016 and is based in Los Angeles, California.

Loading...